Breaking Down the Top 5 Metrics Defining BTC's Real Make-or-Break Level – Is $75K the Bottom?

Original Article Title: "5 Key Data Metrics Revealed: Is There a BTC Buying Opportunity Below $75,000?"

Original Article Author: Mach, Foresight News

Wintermute stated last week that $85,000 was a crucial level for BTC and would choose a direction soon, unfortunately, that direction was not upward but a significant move to the downside.

On February 2nd, BTC briefly dipped to $75,700, ETH to $2,220, while many altcoins remained in a downtrend. In terms of liquidation data, according to Coinglass data, liquidations totaled $435 million in the last 12 hours, with longs liquidated at $324 million.

The market fear index is at 15, with market sentiment once again entering extreme fear.

After the market turned bearish, where exactly is the bottom range for BTC? Let five key data metrics reveal it to you.

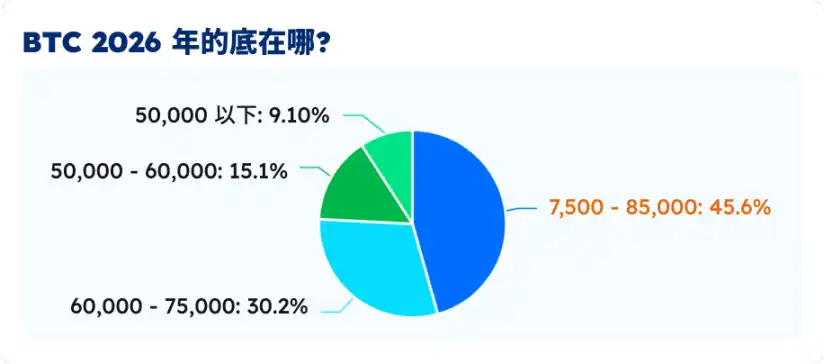

Data Survey: 30% of Users Believe BTC's Bottom Range Is Between $60,000 and $75,000

On January 30th, Foresight News conducted an investor market confidence survey. On that day, when the market survey was conducted, BTC's price was at $84,000. In the following days, it experienced a significant decline, so the survey results are for reference only.

The survey results (1189 votes) showed that the majority of respondents (45.6%) believed that BTC's bottom price in 2026 would be between $75,000 and $85,000. Another 30.2% of respondents believed the bottom price would be between $60,000 and $75,000.

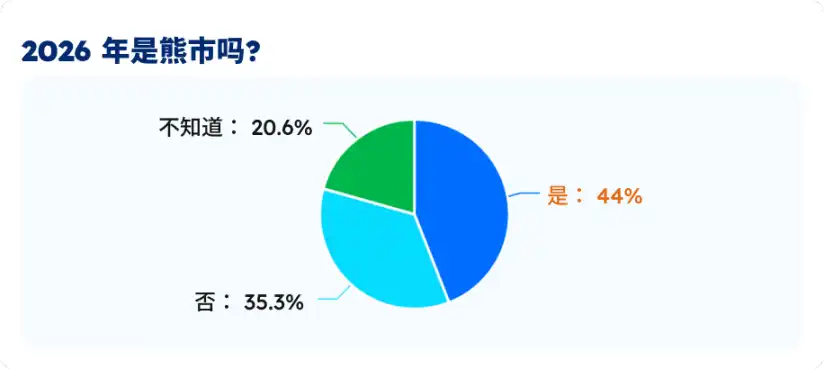

44% of respondents believed that 2026 would be a bear market, while 35.3% of respondents disagreed, thinking it would not be a bear market. Another 20.6% of respondents expressed uncertainty.

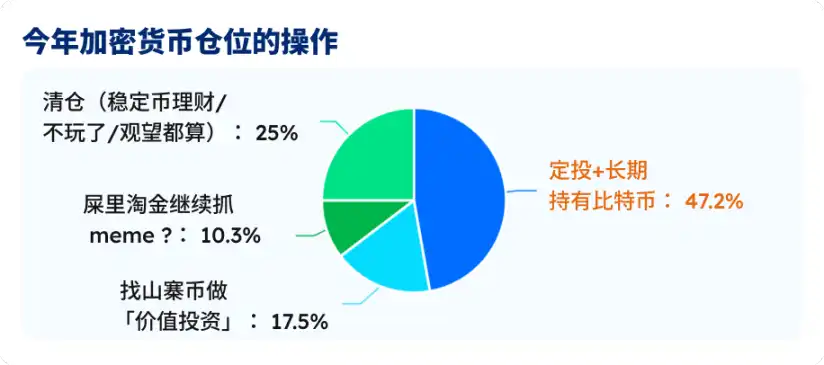

Nearly half of the respondents (47.2%) chose to dollar-cost average and hold Bitcoin long-term. Another 25% of respondents chose to cash out, switch to stablecoin investments, or wait and see the market. 17.5% of respondents looked for altcoins for value investment.

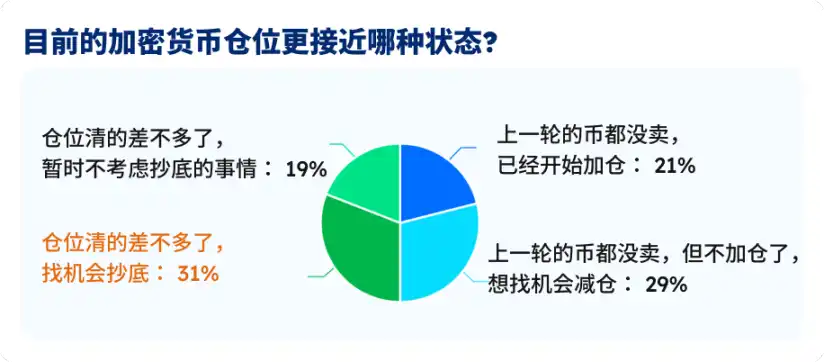

Among the current survey respondents, 31% stated that they had nearly cleared their positions but were still looking for opportunities to buy the dip. 29% of respondents said they hadn't sold any of their coins from the last cycle but were not adding to their position for now, waiting for an opportunity to sell. 21% of respondents said they hadn't sold any of their coins from the last cycle and had started to increase their positions.

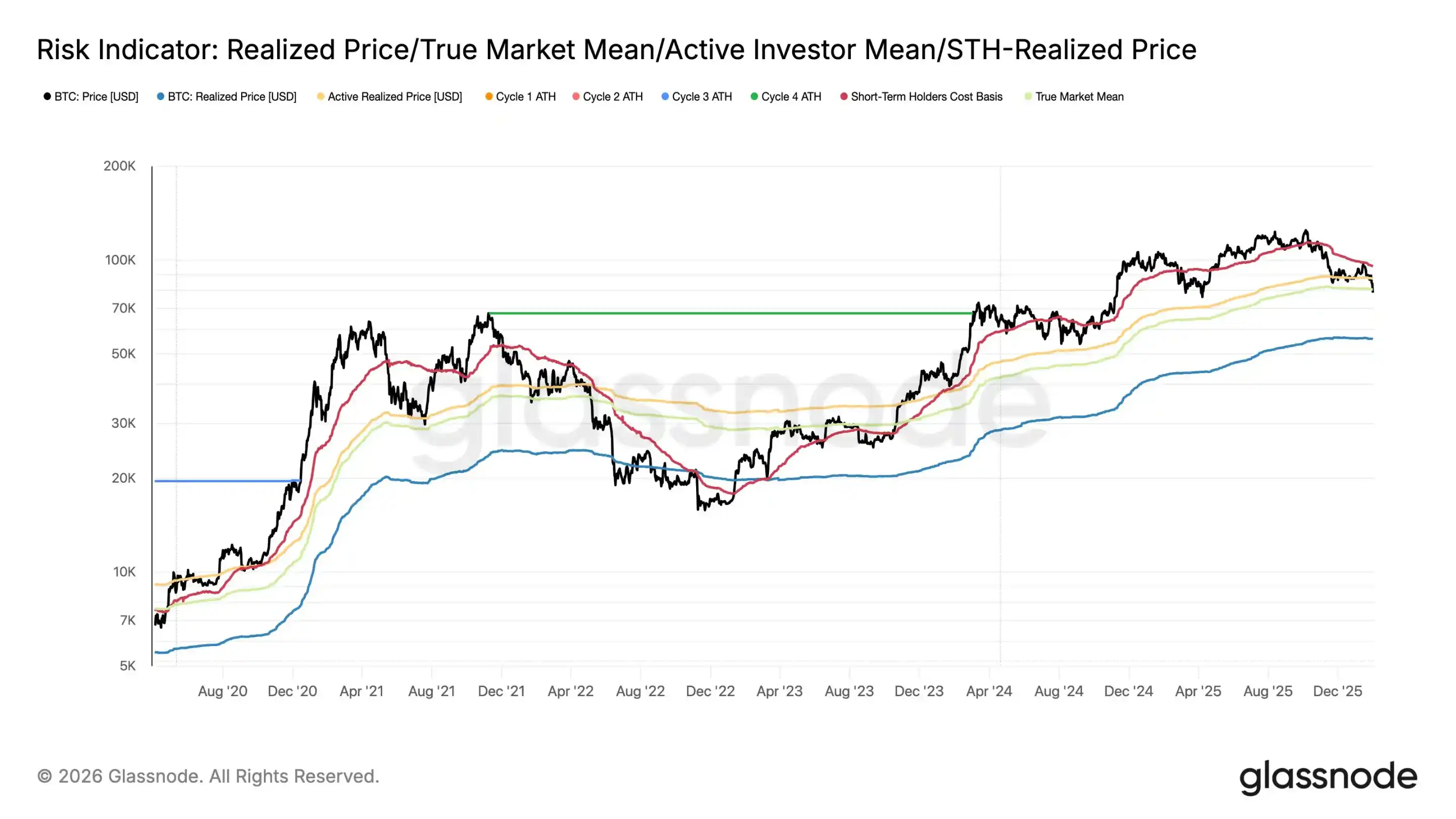

Glassnode Shows BTC On-Chain Cost $55.9k

Bitcoin dropped below $78k, and Glassnode updated the Bitcoin on-chain key price distribution as follows: STH (Short-Term Holder) cost basis, reflecting the average holding price of recent months' new buyer/trader influx, is $95.4k.

Active investor average investment, the current average holding cost of truly "on-chain" traders is $87.3k; the realized market value, focusing on the cost of actual traders in the secondary market, is $80.5k. The realized price, representing the average cost basis of all coins in the entire network, is $55.9k.

Thus, when the BTC price is below $80.5k, the price at which you bought is lower than the recent entry price of other traders. If BTC drops below $55.9k, it means your purchase price is lower than the network's average cost.

In the 2022 cycle bear market, the BTC price once fell below the entire network's average cost basis. In this cycle, whether BTC will drop below $55.9k due to factors such as macro liquidity, spot ETF, etc., remains unknown.

Ahr999 Metric Shows Coin Hoarding Signal

The ahr999 metric, invented by Weibo user ahr999 years ago, is used to assess the short-term return of BTC and price deviation. The formula for this metric is (current price / 200-day DCA cost) × (current price / exponential growth valuation), where the exponential growth valuation is based on a fitting curve of historical prices and block height, representing long-term "fair value." Historical experience shows: ahr999 < 0.45 is a low-price buy zone; 0.45-1.2 is suitable for periodic investment; >1.2 is a high-price zone.

On February 1, 2026, ahr999 first dropped below 0.45, which is the first time in 839 days since October 16, 2023, signaling a potential market bottom. Breaking below this threshold currently implies that the BTC price is significantly below the long-term growth expectation, similar to the late 2023 bear market. This signal strongly suggests buying the dip but requires confirmation of a rebound with volume to avoid a false breakout. Buying the dip strategy: If ahr999 remains stable below 0.45, buying in batches below $76k, and reducing positions when the target rebounds above 1.2.

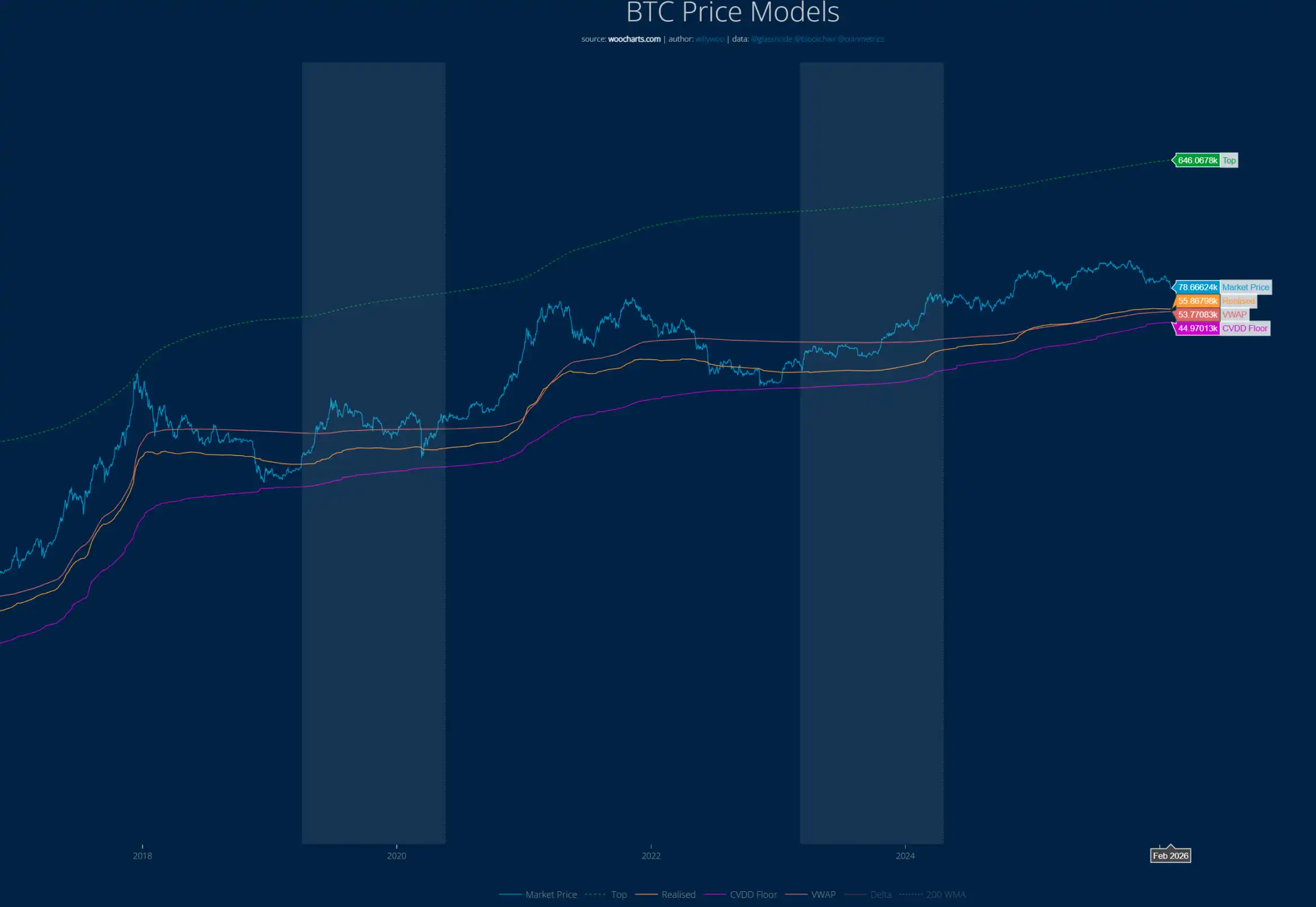

Willy Woo Metric Indicates BTC Price Floor at $45,000

Renowned analyst Willy Woo's developed metric is the CVDD model. When Bitcoin moves from an old investor who bought at $1 to a new investor who bought at $100,000, the new investor will evaluate the value of these bitcoins at a higher floor price, helping to increase the globally recognized price floor of the entire Bitcoin supply. Active custody rotation (i.e., frequent transfers of Bitcoin between different investors or custodians) may also indicate that investors highly value these bitcoins."

When many whales transfer BTC to new Bitcoin wallet addresses, the market's bottom price rises.

The BTC price has never dropped to the red line (CVDD model). Currently, the CVDD metric indicates a price floor of around $45,000. In past cycles, BTC once fell below the yellow line in the chart, with the current range being $53,000 to $56,000.

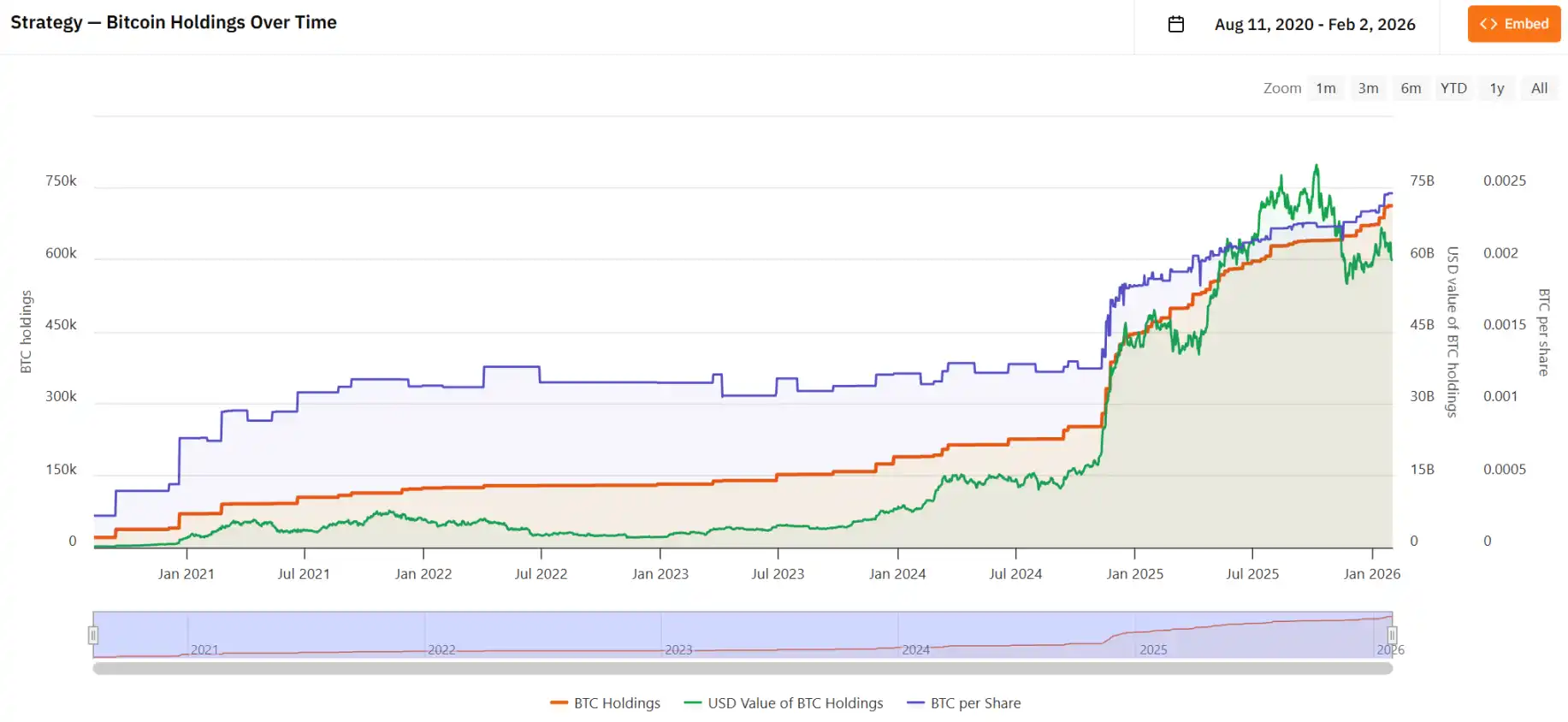

Strategy's Bitcoin Cost Basis $76,000

As of February 2, the well-known Bitcoin hodler Strategy's total holdings were approximately $54.2 billion, holding 712,647 BTC, with an average cost basis of around $76,040.

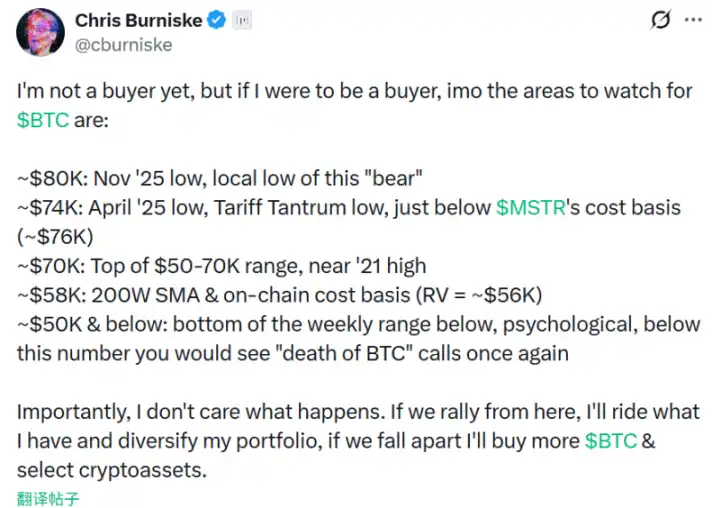

Historically, its average cost basis is considered the bottom range. Placeholder Partner Chris previously stated that the $74,000 to $76,000 range is a very significant price level to watch.

You may also like

The DAO Makes a Comeback Ten Years Later, Establishes $220 Million Security Fund

A $70K Winning Trade: How Ethereum's Founder Plays the Prediction Market

Is the U.S. Stock Market Facing a Crash Risk Tonight as Well?

Breaking Down the Top 5 Metrics Defining BTC's Real Make-or-Break Level – Is $75K the Bottom?

WSJ: $500 Million Investment in WLFI Reveals "Spy Chief" and Trump Family's Money-for-Power Deal

Key Market Information Discrepancy on February 2nd – A Must-See! | Alpha Morning Report

Bitcoin continues to plummet, will Strategy be forced to sell?

Is Moltbook Really a Step Forward, Coinbase's Face-off with Wall Street, What's the Overseas Crypto Community Talking About Today?

Liquidity Crisis Plunge: Why Did Only Bitcoin Fail to Recover?

Is the Crypto Industry Really in Trouble with the Market This Bad?

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…