What is Crypto Crash? Causes, Survival Strategies, and Recovery Tips

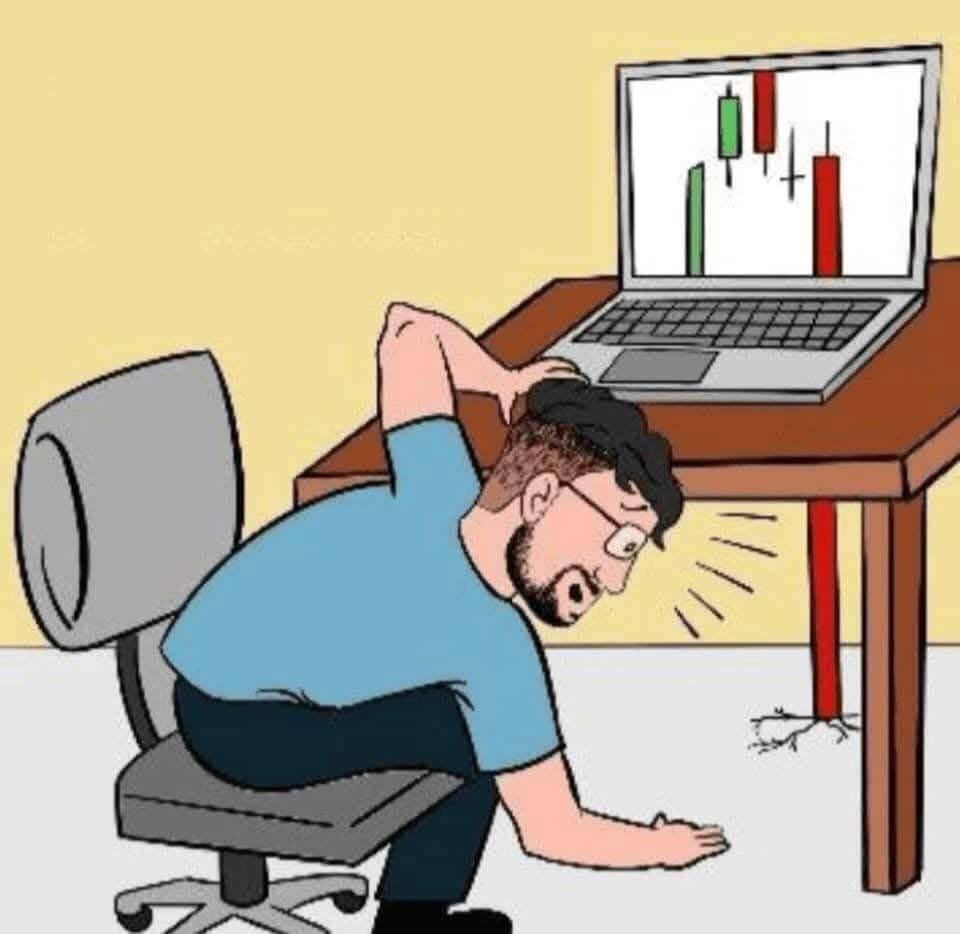

In 2025, the cryptocurrency market continues its wild ride, with highs that excite and crashes that shake even seasoned investors. A crypto crash—a sudden, severe drop in the value of digital assets like Bitcoin or WXT Token—can wipe out billions within hours. Whether you’re buying the dip or wondering where to buy WXT Token safely, this guide unpacks everything you need to know.

We’ll explore the causes of crypto crashes, proven survival strategies, key lessons from past market meltdowns, and expert insights on turning volatility into opportunity.

What is a Crypto Crash? Definition and Historical Context

A crypto crash is a sudden, severe drop in the value of cryptocurrencies, often wiping out billions in market capitalization within days or even hours. Unlike traditional market corrections, which typically see declines of 10-20%, crypto crashes can plummet 50% or more due to the market’s inherent volatility. This volatility stems from cryptocurrencies’ decentralized nature, speculative trading, and sensitivity to external triggers.

Historically, crypto crashes have marked pivotal moments in the market:

- 2018 Bear Market: Bitcoin fell 80% from its $20,000 peak, driven by the ICO bubble burst and regulatory fears.

- 2020 COVID Crash: A sharp drop in March 2020 saw Bitcoin plummet to $4,000, followed by a rapid recovery fueled by DeFi growth.

- 2022 Terra-LUNA Collapse: The algorithmic stablecoin’s failure erased $40 billion, shaking investor confidence.

- 2023 FTX Fallout: The bankruptcy of FTX triggered a market-wide panic, exposing centralized exchange risks.

These events highlight the crypto market’s susceptibility to rapid declines, making it essential to understand what causes a crypto crash.

Why Do Crypto Crashes Happen? 5 Key Triggers

Crypto crashes are rarely caused by a single factor. Here are five primary triggers driving these dramatic downturns:

Market Sentiment & FOMO/FUD Cycles

Speculative hype and fear of missing out (FOMO) often inflate prices, creating bubbles. When negative news or fear, uncertainty, and doubt (FUD) take over, panic selling follows. Social media platforms amplify these cycles, with influencers and news cycles swaying sentiment.

Regulatory Crackdowns

Government policies can destabilize markets. For example, China’s repeated crypto bans and SEC lawsuits against exchanges like Binance have triggered sharp declines. Regulatory uncertainty deters investors, while sudden announcements spark sell-offs.

Exchange Failures & Hacks

High-profile hacks, like the 2014 Mt. Gox breach (losing 850,000 BTC), or exchange failures, like FTX’s collapse, erode trust. These events lead to mass liquidations and market-wide panic.

Overleveraged Trading

Many traders use high leverage, borrowing funds to amplify gains. When prices drop, margin calls force liquidations, creating a cascade effect that drives prices lower. In 2021, overleveraged positions contributed to a 50% Bitcoin crash.

Macroeconomic Factors

Cryptocurrencies, especially Bitcoin, increasingly correlate with stock markets. Rising inflation, interest rate hikes, or global economic uncertainty push investors toward safe-haven assets, triggering crypto sell-offs.

How to Survive a Crypto Crash: 7 Strategies for Investors

Surviving a crypto crash demands a disciplined approach to risk management and emotional resilience. Instead of panic selling, investors should maintain a long-term perspective, focusing on projects with strong fundamentals, like Ethereum’s smart contracts or Chainlink’s oracles. Spreading investments across diverse assets, including stablecoins like USDT or USDC, reduces exposure to volatility. Setting predefined sell points through stop-loss orders can limit losses during sudden drops, while regularly investing fixed amounts—known as dollar-cost averaging—helps smooth out market swings. Staying informed about regulatory shifts and market indicators, such as the Fear & Greed Index, allows for proactive decisions. Above all, avoiding emotional trades driven by fear or hype ensures alignment with a well-thought-out plan, preserving capital through turbulent times.

Crypto Crash Case Studies: Lessons from Past Market Meltdowns

Past crypto crashes offer critical insights into market behavior and resilience. The 2018 bear market, triggered by the ICO bubble’s burst and regulatory fears, saw Bitcoin crash 80% from its peak, exposing the dangers of speculative investments. The 2020 COVID crash sent prices tumbling as global markets panicked, yet a swift recovery fueled by DeFi growth highlighted the market’s potential for quick rebounds. In 2022, the Terra-LUNA collapse, where an algorithmic stablecoin failed, erased billions and underscored risks in untested protocols. Similarly, the 2023 FTX bankruptcy revealed vulnerabilities in centralized exchanges, pushing investors toward self-custody. These events emphasize the importance of researching fundamentals and diversifying to mitigate risks in future downturns.

Post-Crash Recovery: How Markets Bounce Back

Crypto markets have a history of rebounding after crashes. Bitcoin recovered from its 2018 low of $3,200 to hit $69,000 by 2021. Recovery often follows:

- Increased Trading Volume: Rising activity signals renewed investor interest.

- Institutional Adoption: ETFs and corporate investments, like MicroStrategy’s Bitcoin holdings, stabilize markets.

- Regulatory Clarity: Clearer regulations attract cautious investors.

- Positive Sentiment: Social media and on-chain data reflect growing confidence.

Recoveries can take months or years, but historical trends suggest patience pays off.

Expert Tips to Prepare for the Next Crypto Crash

Preparation is key to navigating future crypto crashes with confidence. Experts recommend storing assets in cold wallets, like Ledger or Trezor, to avoid exchange-related risks, emphasizing the importance of self-custody. Monitoring tools such as Glassnode for on-chain activity or CoinGecko for price trends provides real-time insights into market health. Analysts stress discipline, urging investors to stick to a strategy rather than chasing hype or succumbing to panic. As crypto analyst Jane Doe notes, “Diversification and a clear exit plan are your best defenses against market chaos.” Cultivating emotional resilience through mindfulness and limiting exposure to negative news further equips investors to make rational decisions when the market turns turbulent.

Crypto Crash vs. Opportunity: Should You Buy the Dip?

Buying during a crypto crash can be a high-risk, high-reward move. Undervalued projects with strong fundamentals—think Ethereum or Polygon—often recover faster, offering opportunities for savvy investors. However, caution is critical: scams and “dead cat bounces,” where prices briefly rebound before falling further, can trap the unwary. Thorough research into a project’s on-chain activity, developer engagement, and community strength helps identify genuine opportunities. By balancing risks with potential rewards and avoiding impulsive moves, investors can turn a crash into a stepping stone for long-term gains, provided they approach with discipline and due diligence.

FAQ: Common Questions About Crypto Crashes

- What causes a crypto crash?

Crypto crashes are triggered by market speculation, regulatory changes, exchange failures, overleveraged trading, and macroeconomic factors like inflation or interest rate hikes.

- How long do crypto crashes last?

Crashes can last days to months, with recovery timelines varying. The 2018 bear market lasted nearly two years, while the 2020 COVID crash recovered in months.

- Should I sell my crypto during a crash?

Avoid panic selling. Assess your portfolio, stick to your strategy, and consider holding or buying if fundamentals remain strong.

- Which cryptocurrencies survive market crashes?

Established coins like Bitcoin and Ethereum, with strong fundamentals and adoption, tend to recover faster than speculative altcoins.

- Can crypto crashes be predicted?

While exact timing is impossible, monitoring market sentiment, regulatory news, and economic indicators can signal potential downturns.

Latest Updates on WEEX

WEEX Exchange’s WXT Token Surges 101%

If you want to buy WXT now, you can sign up for a WEEX account

WEEX Owen: Michael Owen Joins as Global Brand Ambassador

Championing a revolutionary crypto trading experience

You may also like

What is BIRB? A Deep Dive into Moonbirds Meme Coin and Its Rising Potential

Moonbirds has been making waves in the crypto space with the recent launch of its BIRB token, a…

Nietzschean Penguin Meme Coin Explained: What Is It & Price Prediction & Legit or Scam?

Nietzschean Penguin Coin explained: what is PENGUIN, why it went viral in 2026, price prediction, legit or scam analysis, risks, and how to buy this Solana penguin meme coin.

What Is United Stables (U) and How Does It Work?

United Stables U Token represents a fundamental evolution in the stablecoin landscape, combining price stability with native yield generation in a single digital asset. Unlike traditional stablecoins that maintain a static 1:1 peg, U introduces an innovative hybrid collateralization model that not only preserves value but also actively generates returns for holders.

Who Owns World Liberty Financial? Exploring Ownership, WLFI Token Insights, and Market Outlook

World Liberty Financial has been making waves in the crypto space lately, especially with its WLFI token climbing…

How to Buy USOR Crypto: A Beginner’s Guide to Purchasing on WEEX Exchange

USOR crypto has caught attention lately with a sharp 34.63% price surge in the last 24 hours, pushing…

What Is USOR Crypto? Exploring the U.S. Oil Token’s Rise and Future in the Energy-Backed Crypto Space

U.S. Oil (USOR) crypto has caught attention recently with a sharp 34.63% price surge over the last 24…

Is USOR (U.S Oil) Real or Fake? Uncovering the Truth Behind This Rising Crypto Token

In the fast-paced world of cryptocurrency, new tokens like USOR (U.S Oil) often spark curiosity and skepticism. As…

Where to Buy USOR Crypto: Best Platforms and Strategies for Beginners

With USOR crypto surging 39.48% in the last 24 hours to hit $0.027753 USD, as reported by CoinMarketCap…

Where Can I Buy USOR Crypto? Is USOR Crypto Legit? Your Guide to Getting Started

The USOR crypto token, tied to the U.S Oil project, has caught attention with its recent surge. As…

Is USOR Crypto Real or Fake? Uncovering the Truth Behind U.S. Oil Token

The U.S. Oil token, known as USOR, has caught attention in the crypto space with its recent 24.24%…

XTP USDT Pair Debuts on WEEX: Tap (XTP) Coin Listing

WEEX Exchange, a leading platform for crypto trading, has officially listed the Tap (XTP) coin, opening up new…

BP USDT World Premiere on WEEX: Barking Puppy (BP) Coin Listed

According to CoinMarketCap, Barking Puppy (BP) is a fresh memecoin inspired by viral internet culture, launched just days…

Nietzschean Penguin (PENGUIN) Coin Price Prediction & Forecasts for January 2026: Surging 28% Amid Meme Coin Hype

Nietzschean Penguin (PENGUIN) Coin has been turning heads in the meme coin space, blending Nietzschean philosophy with adorable…

Nietzschean Penguin Latest News: Trump’s Meme Tweet Ignites $PENGUIN Rally and What’s Next for This Solana Meme Coin

The Nietzschean Penguin latest news has taken the crypto world by storm, thanks to a viral White House…

What Is Tap (XTP) Coin?

Tap (XTP) Coin is a recently listed token on WEEX, now available for trading. Launched on January 27,…

What is Copper Inu (COPPERINU) Coin?

Copper Inu (COPPERINU), a new cryptocurrency inspired by whimsical Twitter memes of copper-colored Inu dogs, just made its…

What is Barking Puppy (BP) Coin?

Making its debut in the crypto arena, Barking Puppy (BP) is a novel digital asset that’s catching the…

BP USDT Exclusive Premiere on WEEX: Barking Puppy (BP) Coin Listing

WEEX Exchange proudly announces the world premiere listing of Barking Puppy (BP) Coin, an exciting new token inspired…

What is BIRB? A Deep Dive into Moonbirds Meme Coin and Its Rising Potential

Moonbirds has been making waves in the crypto space with the recent launch of its BIRB token, a…

Nietzschean Penguin Meme Coin Explained: What Is It & Price Prediction & Legit or Scam?

Nietzschean Penguin Coin explained: what is PENGUIN, why it went viral in 2026, price prediction, legit or scam analysis, risks, and how to buy this Solana penguin meme coin.

What Is United Stables (U) and How Does It Work?

United Stables U Token represents a fundamental evolution in the stablecoin landscape, combining price stability with native yield generation in a single digital asset. Unlike traditional stablecoins that maintain a static 1:1 peg, U introduces an innovative hybrid collateralization model that not only preserves value but also actively generates returns for holders.

Who Owns World Liberty Financial? Exploring Ownership, WLFI Token Insights, and Market Outlook

World Liberty Financial has been making waves in the crypto space lately, especially with its WLFI token climbing…

How to Buy USOR Crypto: A Beginner’s Guide to Purchasing on WEEX Exchange

USOR crypto has caught attention lately with a sharp 34.63% price surge in the last 24 hours, pushing…

What Is USOR Crypto? Exploring the U.S. Oil Token’s Rise and Future in the Energy-Backed Crypto Space

U.S. Oil (USOR) crypto has caught attention recently with a sharp 34.63% price surge over the last 24…