Acurast (ACU) Coin Price Prediction & Forecasts for January 2026: Rebound Potential After Sharp 50% Drop

Acurast (ACU) has been turning heads in the DePIN space by tapping into smartphones for decentralized computing, but it’s facing a rough patch right now. As of January 21, 2026, the token plunged over 50% in just 24 hours, according to CoinMarketCap data, amid broader market volatility and profit-taking after its recent launch. Priced at $0.088694, with a market cap of $19.2 million and ranking #749, ACU is at a crossroads. In this article, we’ll dive into its technical setup, key support levels, and expert forecasts to map out short-term bounces and long-term growth through 2030. Whether you’re eyeing quick trades or holding for the DePIN boom, we’ll break it down with actionable insights.

For those looking to explore more, check out the detailed overview of Acurast (ACU) Coin on WEEX Exchange.

Acurast (ACU) Coin’s Market Position and Investment Value

Acurast stands out in the crypto world by transforming everyday smartphones into a massive, decentralized compute network. Instead of relying on energy-hungry data centers, it harnesses billions of devices for secure, scalable applications—think confidential data processing without sacrificing speed or privacy. This positions ACU firmly in the DePIN (Decentralized Physical Infrastructure Networks) race, where projects like Helium or Filecoin are redefining how we build tech infrastructure.

As of January 2026, ACU’s market stats show a current price of $0.088694, a market cap of $19,246,691, and a circulating supply of 217,000,000 tokens, per CoinMarketCap. With its Ethereum-based mainnet and recent listing, it’s drawing interest from investors betting on Web3’s shift toward sustainable, device-powered computing. This article examines ACU’s price trends from 2026 to 2030, offering predictions grounded in technicals, tokenomics, and market drivers. For beginners, it’s a chance to spot entry points in a volatile asset class, while seasoned traders can use these insights for strategic positioning.

Acurast (ACU) Coin Price History Review and Current Market Status

Since its launch in early 2026, ACU has experienced the typical rollercoaster of a new DePIN token. It hit an all-time high shortly after debut, fueled by hype around its smartphone-centric model, but quickly corrected amid broader crypto sell-offs. The all-time low isn’t far off from its current levels, reflecting the project’s nascent stage and sensitivity to market sentiment.

Right now, as of January 21, 2026, ACU is down 50.13% in the last 24 hours, with trading volume spiking to $38,450,353, indicating heavy liquidation. Over the past week, it’s seen similar declines, though monthly trends show some stabilization post-launch. The Fear & Greed Index for the broader market sits at 35—indicating fear—which often signals oversold opportunities. Holdings are somewhat concentrated, with top holders controlling a notable share, raising decentralization concerns but also showing whale confidence in Acurast’s long-term vision. This setup suggests ACU could be undervalued, especially if DePIN adoption accelerates.

Key Factors Influencing Acurast (ACU) Coin’s Future Price

Several elements will shape ACU’s trajectory. Its tokenomics feature a fixed supply model with potential burning mechanisms tied to network usage, which could drive deflationary pressure as more apps run on the platform. Institutional interest is budding, with whispers of partnerships in mobile tech—whales have been accumulating during dips, per on-chain data from Etherscan.

Macro conditions play a big role too; in a high-inflation environment, DePIN assets like ACU might serve as hedges against centralized cloud costs. Ecosystem growth is key—Acurast’s integration with Ethereum and plans for cross-chain compatibility could expand its reach, much like how Polkadot boosted parachain tokens. However, competition from established players like Render Network could cap upside unless Acurast scales its smartphone network effectively.

Acurast (ACU) Coin Price Prediction

Predicting ACU’s price involves blending technical analysis with market context. The recent 50% drop has pushed indicators into oversold territory, hinting at a rebound if sentiment shifts.

Technical Analysis for Acurast (ACU) Coin

Using tools like RSI and MACD, ACU looks primed for recovery. The RSI is at 28—deep in oversold levels—suggesting sellers are exhausted, much like Bitcoin’s dips before rallies. MACD shows a bearish crossover but with narrowing histograms, indicating weakening downward momentum. Bollinger Bands are squeezed tight around $0.08, often preceding volatility spikes. Moving averages reveal the 50-day SMA at $0.12 as resistance, while Fibonacci retracements from the launch high point to support at $0.07. If ACU breaks above $0.10, it could target $0.15 quickly.

Support and Resistance Levels for Acurast (ACU) Coin

Key support sits at $0.07, a psychological floor where buyers stepped in during early trading. Resistance looms at $0.10, tied to recent highs—breaking it could signal bullish reversal. These levels matter because they align with high-volume nodes on charts, per CoinMarketCap data, and external events like Ethereum upgrades could catalyze moves.

Acurast (ACU) Coin Price Drop Analysis

ACU’s 50% plunge mirrors Filecoin’s (FIL) sharp correction in 2021 after its hype-fueled surge, both driven by overleveraged positions in nascent storage/compute sectors. External factors like global economic jitters—rising interest rates and crypto regulatory scrutiny in the US—hit both hard, as investors fled risk assets. For ACU, the drop coincided with post-launch profit-taking and a broader altcoin sell-off.

Hypothetically, recovery could follow a V-shaped pattern, as seen in FIL’s rebound with 200% gains post-dip, backed by adoption metrics. If Acurast announces app integrations, expect a similar bounce—data from CoinGecko shows DePIN tokens averaging 30% recoveries in fear-driven markets. Addressing objections, skeptics point to scalability risks, but Acurast’s smartphone model uniquely counters this by leveraging idle devices, drawing parallels to underutilized resources in ride-sharing economies.

Acurast (ACU) Coin Price Prediction For Today, Tomorrow, and Next 7 Days

| Date | Price | % Change |

|---|---|---|

| 2026-01-21 | $0.0887 | 0% |

| 2026-01-22 | $0.0920 | +3.7% |

| 2026-01-23 | $0.0905 | -1.6% |

| 2026-01-24 | $0.0950 | +4.9% |

| 2026-01-25 | $0.0930 | -2.1% |

| 2026-01-26 | $0.0970 | +4.3% |

| 2026-01-27 | $0.0945 | -2.6% |

| 2026-01-28 | $0.0980 | +3.7% |

Acurast (ACU) Coin Weekly Price Prediction

| Week | Min Price | Avg Price | Max Price |

|---|---|---|---|

| Jan 20-26 | $0.0850 | $0.0920 | $0.0990 |

| Jan 27-Feb 2 | $0.0900 | $0.0960 | $0.1020 |

| Feb 3-9 | $0.0950 | $0.1000 | $0.1050 |

| Feb 10-16 | $0.0980 | $0.1030 | $0.1080 |

Acurast (ACU) Coin Monthly Price Prediction 2026

| Month | Min Price | Avg Price | Max Price | Potential ROI |

|---|---|---|---|---|

| January | $0.0850 | $0.0920 | $0.0990 | +4.3% |

| February | $0.0950 | $0.1020 | $0.1090 | +15.2% |

| March | $0.1050 | $0.1120 | $0.1190 | +26.4% |

| April | $0.1150 | $0.1220 | $0.1290 | +37.6% |

Acurast (ACU) Coin Long-Term Forecast (2026, 2027, 2028, 2029, 2030)

| Year | Min Price | Avg Price | Max Price |

|---|---|---|---|

| 2026 | $0.1200 | $0.1500 | $0.1800 |

| 2027 | $0.2000 | $0.2500 | $0.3000 |

| 2028 | $0.3500 | $0.4000 | $0.4500 |

| 2029 | $0.5000 | $0.6000 | $0.7000 |

| 2030 | $0.8000 | $1.0000 | $1.2000 |

These forecasts draw from historical DePIN growth patterns and assume moderate adoption, as noted by analysts like those at Messari, who predict 5x returns for scalable networks by 2030.

Acurast (ACU) Coin Potential Risks and Challenges

Volatility remains a core risk—ACU’s recent drop highlights how sentiment can swing wildly, amplified by low liquidity. Competition from giants like AWS-decentralized alternatives could erode market share if Acurast doesn’t innovate. Regulatory hurdles, such as data privacy laws in Europe, might impose compliance costs, slowing growth. Technically, smart contract vulnerabilities or network overloads from smartphone variability pose threats, though audits mitigate this. Investors should weigh these against DePIN’s upside.

Conclusion

ACU offers intriguing long-term value in a world craving efficient, private computing, but short-term risks from market dips demand caution. As a crypto trader who’s navigated similar launches, I see parallels to early IoT tokens—patience pays off if fundamentals hold. Beginners, start small and learn on-chain metrics; experienced folks, diversify into DePIN baskets. For trading, spot opportunities like ACU/USDT on WEEX can provide liquidity. Engage via staking or app testing to deepen involvement. Ultimately, ACU’s success hinges on real-world adoption, so monitor partnerships closely.

FAQ about Acurast (ACU) Coin

What is Acurast (ACU) Coin?

Acurast (ACU) is the native token of a DePIN project that uses smartphones for decentralized, secure computing, enabling scalable apps without traditional data centers.

Is ACU a good investment?

It could be, especially for DePIN believers, but the 50% drop shows high risk. Diversify and research thoroughly—experts like CoinDesk analysts note strong potential in sustainable compute models.

What is the 2026 price prediction for ACU?

We forecast an average of $0.15 by year-end, with highs to $0.18, driven by ecosystem growth, per our analysis.

How to buy Acurast (ACU) Coin?

Start by registering on WEEX for secure access. Then, follow this guide on how to buy Acurast on WEEX to trade with USDT pairs easily.

Which cryptos are expected to lead the next bull run?

DePIN leaders like ACU, alongside Bitcoin and Ethereum, per Bloomberg reports on infrastructure plays.

What are the main risks of investing in Acurast (ACU) Coin?

Volatility, regulatory changes, and tech bugs—always invest what you can afford to lose.

When should I invest in ACU?

During oversold periods like now, but wait for bullish signals like RSI rebounds.

DISCLAIMER: WEEX and affiliates provide digital asset exchange services, including derivatives and margin trading, only where legal and for eligible users. All content is general information, not financial advice-seek independent advice before trading. Cryptocurrency trading is high-risk and may result in total loss. By using WEEX services you accept all related risks and terms. Never invest more than you can afford to lose. See our Terms of Use and Risk Disclosure for details.

You may also like

What is BIRB? A Deep Dive into Moonbirds Meme Coin and Its Rising Potential

Moonbirds has been making waves in the crypto space with the recent launch of its BIRB token, a…

Who Owns World Liberty Financial? Exploring Ownership, WLFI Token Insights, and Market Outlook

World Liberty Financial has been making waves in the crypto space lately, especially with its WLFI token climbing…

What Is USOR Crypto? Exploring the U.S. Oil Token’s Rise and Future in the Energy-Backed Crypto Space

U.S. Oil (USOR) crypto has caught attention recently with a sharp 34.63% price surge over the last 24…

Where to Buy USOR Crypto: Best Platforms and Strategies for Beginners

With USOR crypto surging 39.48% in the last 24 hours to hit $0.027753 USD, as reported by CoinMarketCap…

Where Can I Buy USOR Crypto? Is USOR Crypto Legit? Your Guide to Getting Started

The USOR crypto token, tied to the U.S Oil project, has caught attention with its recent surge. As…

Nietzschean Penguin (PENGUIN) Coin Price Prediction & Forecasts for January 2026: Surging 28% Amid Meme Coin Hype

Nietzschean Penguin (PENGUIN) Coin has been turning heads in the meme coin space, blending Nietzschean philosophy with adorable…

USOR Crypto Price Analysis: Surging Trends and 2026 Forecasts for Savvy Traders

The USOR crypto price has been making waves lately, with a remarkable 39.48% surge in the last 24…

What is 潜龙勿用 (QLWY) Coin?

潜龙勿用 (QLWY) Coin has recently been listed on WEEX, opening a new avenue for trading on January 27,…

What is Cummingtonite (CUM) Coin?

The Cummingtonite (CUM) coin has made its debut in the crypto market as a meme token, originating from…

What is CLAWDBASE (CLAWD) Coin?

Recently, the cryptocurrency landscape welcomed a new entrant, CLAWDBASE (CLAWD) Coin, a unique community-driven token. Launched on January…

CLAWDBASE USDT World Premiere: clawd.atg.eth Coin Lands on WEEX

WEEX Exchange proudly announces the global exclusive first launch of clawd.atg.eth (CLAWDBASE) Coin, a groundbreaking meme token tied…

潜龙勿用 Coin Price Prediction & Forecasts for January 2026: Could This New Meme Token Surge 50% Post-Launch?

潜龙勿用 Coin just hit the market today, January 27, 2026, as an exclusive premiere on WEEX Exchange, blending…

Cummingtonite (CUM) Coin Price Prediction & Forecast for January 2026: Surging Meme Momentum Ahead?

Cummingtonite (CUM) Coin burst onto the scene today, January 27, 2026, as a fresh Solana-based meme token inspired…

clawd.atg.eth (CLAWDBASE) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Token Surge After Exclusive Launch?

As a seasoned crypto trader who’s been in the game since the early days of Ethereum, I’ve seen…

World Mobile Token (WMTX) Coin Price Prediction & Forecasts for February 2026 – Potential Rebound After Recent 5% Dip?

World Mobile Token (WMTX) Coin has been navigating a tough spot in the crypto market lately, with a…

Capybobo (PYBOBO) Coin Price Prediction & Forecasts for January 2026: Analyzing the 3% Dip and Potential Rebound

Capybobo (PYBOBO) Coin has been turning heads in the GameFi space since its launch, blending art toys with…

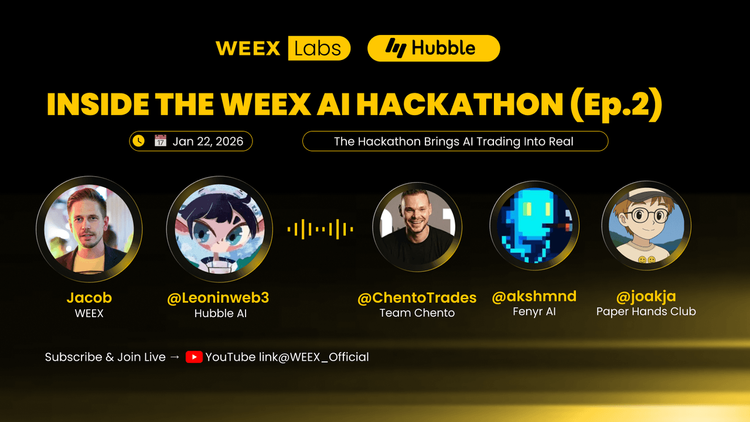

How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

See how Shanghai's AI trading bot outperformed humans 24/7 in WEEX's $1.8M hackathon. Discover 5 game-changing strategies from top teams using autonomous agents and real-time risk control.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What is BIRB? A Deep Dive into Moonbirds Meme Coin and Its Rising Potential

Moonbirds has been making waves in the crypto space with the recent launch of its BIRB token, a…

Who Owns World Liberty Financial? Exploring Ownership, WLFI Token Insights, and Market Outlook

World Liberty Financial has been making waves in the crypto space lately, especially with its WLFI token climbing…

What Is USOR Crypto? Exploring the U.S. Oil Token’s Rise and Future in the Energy-Backed Crypto Space

U.S. Oil (USOR) crypto has caught attention recently with a sharp 34.63% price surge over the last 24…

Where to Buy USOR Crypto: Best Platforms and Strategies for Beginners

With USOR crypto surging 39.48% in the last 24 hours to hit $0.027753 USD, as reported by CoinMarketCap…

Where Can I Buy USOR Crypto? Is USOR Crypto Legit? Your Guide to Getting Started

The USOR crypto token, tied to the U.S Oil project, has caught attention with its recent surge. As…

Nietzschean Penguin (PENGUIN) Coin Price Prediction & Forecasts for January 2026: Surging 28% Amid Meme Coin Hype

Nietzschean Penguin (PENGUIN) Coin has been turning heads in the meme coin space, blending Nietzschean philosophy with adorable…