SEC Announces "PoW Mining Does Not Constitute Securities Issuance" Action, Miners Welcome Regulatory Spring

Original Article Title: "SEC Announces 'PoW Mining Not Considered Securities,' Miners Do Not Need to Register, Welcoming a Major Regulatory Victory"

Original Article Author: Natalia Wu, BlockTempo

The U.S. Securities and Exchange Commission (SEC) announced regulatory guidance on Proof of Work (PoW) mining activities on the 20th, and for the first time concluded that "PoW mining activities do not constitute a securities offering," thus exempting them from federal securities law regulation, and mining participants do not need to register with the SEC.

This decision provides clear regulatory clarity for PoW miners and mining pools, alleviating their concerns about compliance with U.S. securities laws.

SEC Confirms PoW Mining Exempt from Securities Law Regulation

The SEC views PoW mining as an "administrative or transactional activity" rather than an investment contract. Miners validate transactions and secure the blockchain network by providing computational resources, earning newly minted cryptocurrency (referred to as "Covered Crypto Assets") as a reward. This process does not rely on third-party management or entrepreneurial efforts, which is a key criterion in the Howey test (used to determine whether an asset is a security).

The SEC considers "protocol mining" as the process of validating transactions and maintaining network security on a PoW blockchain. These networks are decentralized, permissionless systems, and miners add new blocks to the blockchain by solving complex cryptographic puzzles. Miners can participate without owning the network's native cryptocurrency, further distinguishing mining from securities issuance.

The SEC stated that its declaration covers only "protocol mining" activities involving:

• Miners mining cryptographic assets on a PoW network: The SEC emphasizes that these rewards come from the miners' own efforts, not third-party management, making them administrative tasks rather than securities transactions.

• The roles of mining pools and pool operators participating in the protocol mining process, including their roles in earning and distributing rewards. The SEC believes that miners' earnings in the pool are related to their computational contributions, not the pool operator's efforts, so these activities are also exempt from securities law regulation.

Cryptocurrency Mining Industry Regulatory Victory

This clarification is a significant victory for the PoW mining community. The SEC's confirmation that mining is not subject to securities regulation means that miners and pool operators can continue their operations without registering or complying with additional legal requirements. This decision may enhance confidence in the mining industry, especially in the context of ongoing regulatory scrutiny of mining due to energy consumption and environmental impact concerns.

It is worth noting that, after the Trump administration, the SEC has ushered in a crypto-friendly new leadership team and has been committed to providing a clearer regulatory stance. The SEC first defined the classification of digital assets at the end of February, categorizing Bitcoin as a digital commodity and determining that meme coins are not securities, with investors bearing the risk.

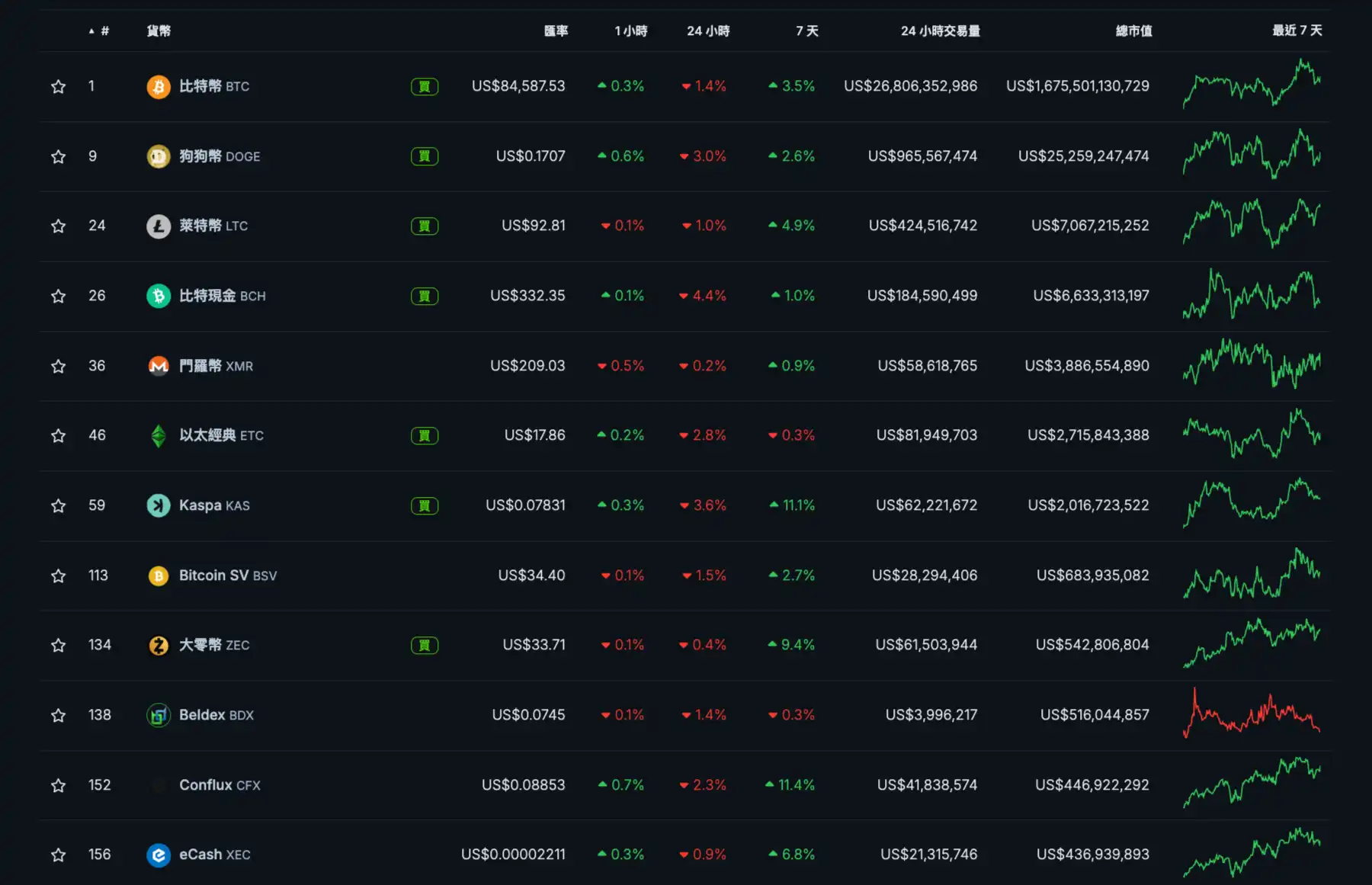

PoW Coins Experience Overall Decline in the Past 24 Hours

However, following the SEC's announcement, the prices of PoW tokens did not show a significant increase. In the past 24 hours, they followed the overall cryptocurrency market trend and experienced a general decline.

Due to the lack of highlights and substantial positive news in Trump's speech at the digital asset summit, as well as the escalating tariff war raising risk aversion sentiment, Bitcoin plummeted from $86,529 last night to a low of $83,642, a 3.3% drop, and has since slightly rebounded to $84,528, representing a 1.5% decline in the past 24 hours.

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Untitled

I’m sorry, but without content to rewrite, I’m unable to produce an article within the specified word count…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…