On the Eve of a Significant Dollar Devaluation, Bitcoin is Poised for the Final Spark

Original Article Title: BTC: Onchain Data Update + our views on last week's FOMC and the "big picture"

Original Article Author: Michael Nadeau, The DeFi Report

Original Article Translation: Bitpush News

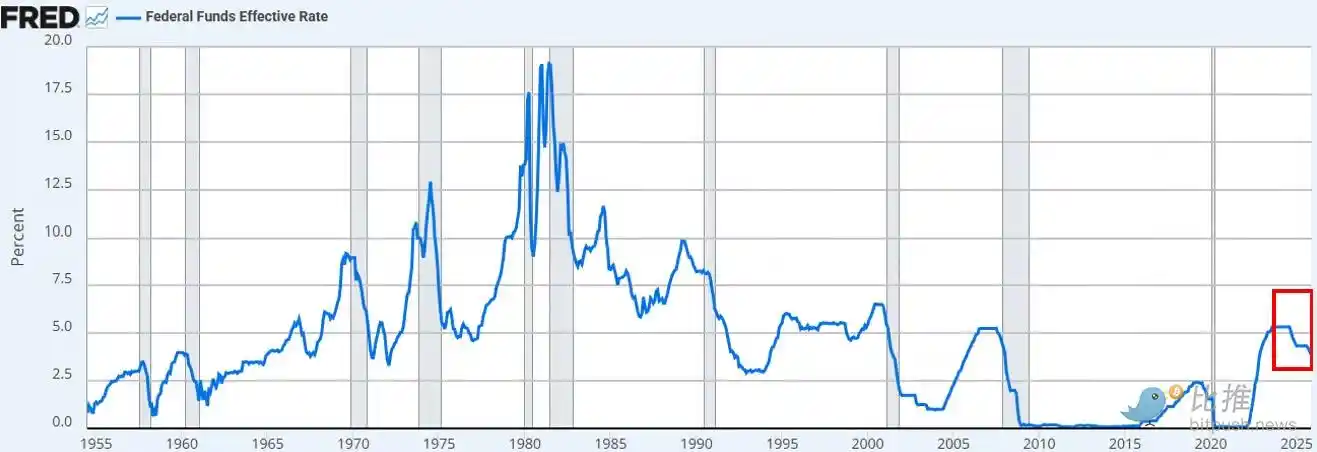

Last week, the Federal Reserve cut interest rates to a target range of 3.50%–3.75%—this move was fully absorbed by the market and largely expected.

What truly surprised the market was the Federal Reserve's announcement to purchase $400 billion in short-term Treasury bills on a monthly basis, which quickly earned the label of "QE-lite" by some.

In today's report, we will delve into what this policy change really means, what it doesn't change, and why this distinction is crucial for risk assets.

Let's get started.

1. "Short-term" Outlook

The Federal Reserve cut rates as expected. This is the third rate cut this year and the sixth since September 2024, totaling a 175 basis point reduction and pushing the federal funds rate to its lowest level in about three years.

In addition to the rate cut, Powell announced that the Fed will begin "reserve management purchases" of short-term Treasury bills at a pace of $400 billion per month starting in December. Given the ongoing strains in the repo market and bank sector liquidity, this move was entirely within our expectations.

The prevailing market view (whether on X platform or CNBC) is that this is a "dovish" policy shift.

The debate on whether the Fed's announcement is equivalent to "money printing," "QE," or "QE-lite" immediately took over social media timelines.

Our Observation:

As a "market observer," we find that the market's psychological state still tends towards "Risk-on" sentiment. In this state, we expect investors to overly fit policy headlines, trying to piece together a bullish logic while overlooking the specific mechanism of how policy translates into actual financial conditions.

Our view is: The Fed's new policy is favorable for the "financial market plumbing," but not favorable for risk assets.

Where do we differ from the market's general perception?

Our views are as follows:

· Short-Term Treasury Purchases ≠ Absorption of Market Duration

The Fed is purchasing short-term Treasury bills, not long-term coupon bonds. This does not remove the market's interest rate sensitivity (duration).

· Has Not Suppressed Long-Term Yields

Although short-term purchases may marginally reduce future long-term bond issuance, it does not help compress the term premium. Currently, about 84% of Treasury issuances are in short-term notes, so this policy does not substantially alter the duration structure investors face.

· Financial Conditions Are Not Broadly Loosened

These reserve management purchases aimed at stabilizing the repo market and bank liquidity will not systematically lower real interest rates, corporate borrowing costs, mortgage rates, or equity discount rates. Their impact is partial and functional, not a broad-based monetary easing.

Therefore, no, this is not QE. This is not financial repression. What needs to be clear is that the abbreviation does not matter; you can call it money printing if you like, but it does not deliberately suppress long-term yields by removing duration — which would push investors towards the riskier end of the curve.

That scenario has not materialized. The price action of BTC and the Nasdaq index since last Wednesday affirm this point.

What would change our view?

We believe BTC (as well as broader risk assets) will have their time in the sun. But that will come post-QE (or whatever the Fed terms the next phase of financial repression).

That moment will arrive when:

· The Fed artificially suppresses the long end of the yield curve (or signals to the market).

· Real Interest Rates Decrease (Due to Rising Inflation Expectations).

· Corporate Borrowing Costs Decline (Powering Tech Stocks/NASDAQ).

· Term Premium Compression (Long-Term Rates Decrease).

· Stock Discount Rates Decrease (Forcing Investors into Longer Duration Risk Assets).

· Mortgage Rates Decline (Driven by Long-End Rate Suppression).

At that point, investors will smell the scent of "Financial Repression" and adjust their portfolios. We are not yet in that environment, but we believe it is coming. While timing is always difficult, our baseline assumption is: volatility will significantly increase in the first quarter of next year.

This is what we see as the short-term landscape.

2. A More Macro View

The deeper issue is not the Fed's short-term policies but the global trade (currency) war and the tension it is creating at the core of the dollar system.

Why?

The U.S. is moving towards the next stage of its strategy: reshoring manufacturing, reshaping global trade balances, and competing in strategic industries like AI. This goal is in direct conflict with the role of the dollar as the world's reserve currency.

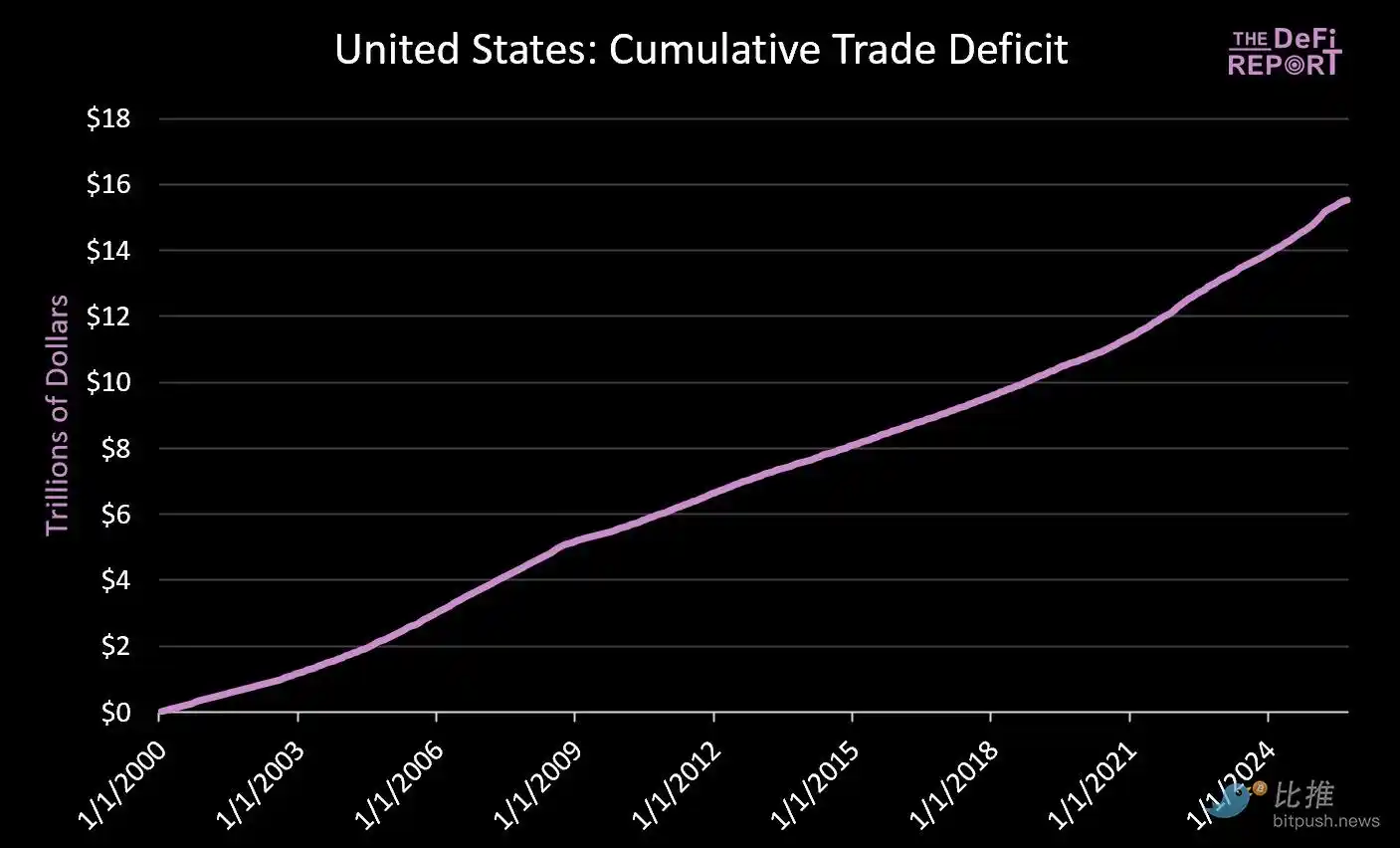

The reserve currency status can only be maintained as long as the U.S. continues to run a trade deficit. Under the current system, the dollar is sent overseas to purchase goods, which then flow back to the U.S. capital markets through treasuries and risk assets. This is the essence of the Triffin Dilemma.

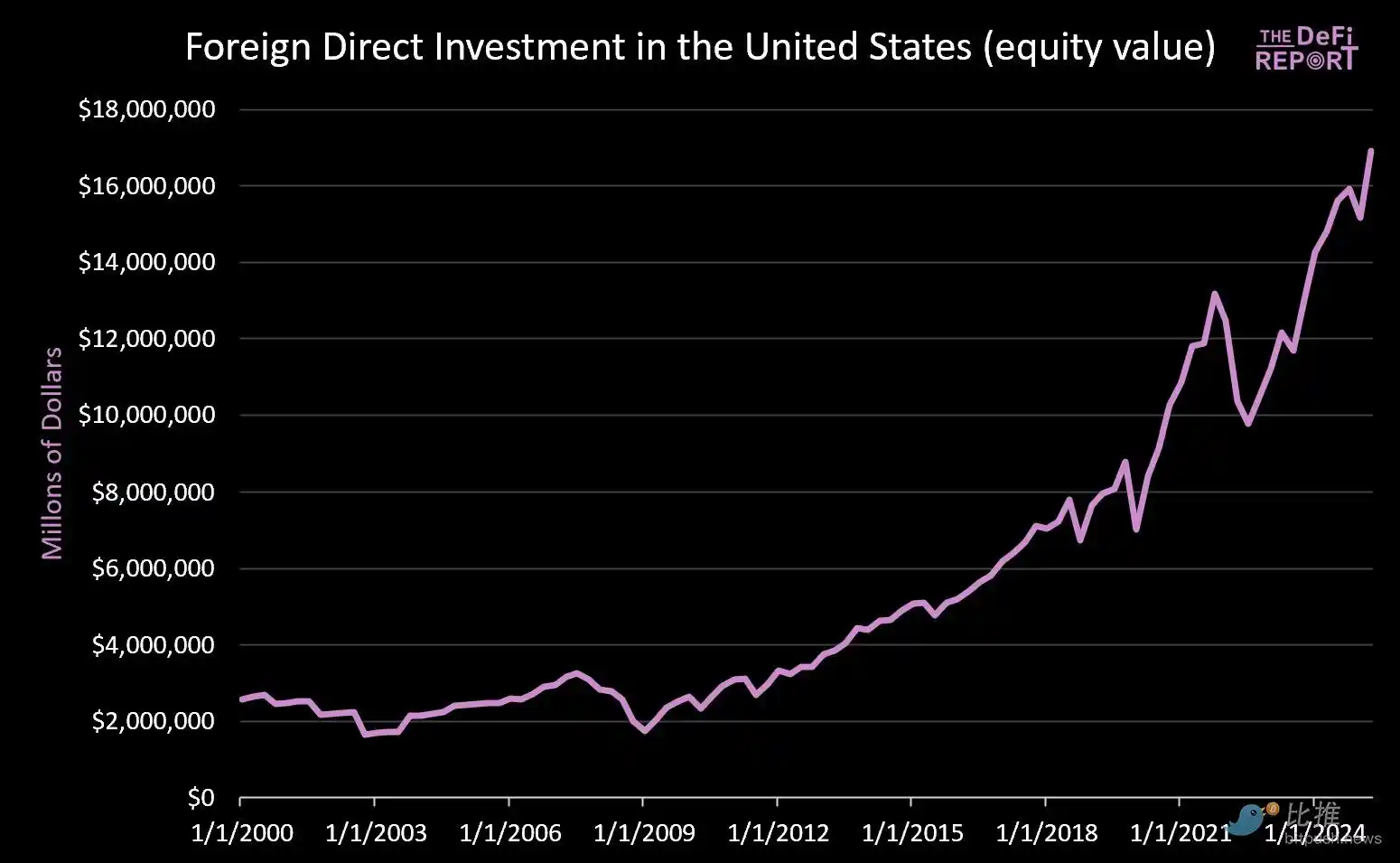

· Since January 1, 2000, the U.S. capital markets have received over $14 trillion (not counting the $9 trillion in bonds currently held by foreigners).

· At the same time, around $16 trillion has flowed offshore to pay for goods.

The effort to reduce the trade deficit will necessarily reduce the cyclical capital flowing back to the U.S. market. While Trump touts promises from Japan and other countries to "invest $550 billion in U.S. industry," what he fails to explain is that Japan's (and other countries') capital cannot simultaneously exist in manufacturing and capital markets.

We believe this tension will not be resolved smoothly. Instead, we expect increased volatility, asset repricing, and ultimately a currency adjustment (i.e., dollar devaluation and a shrinkage in the real value of U.S. Treasuries).

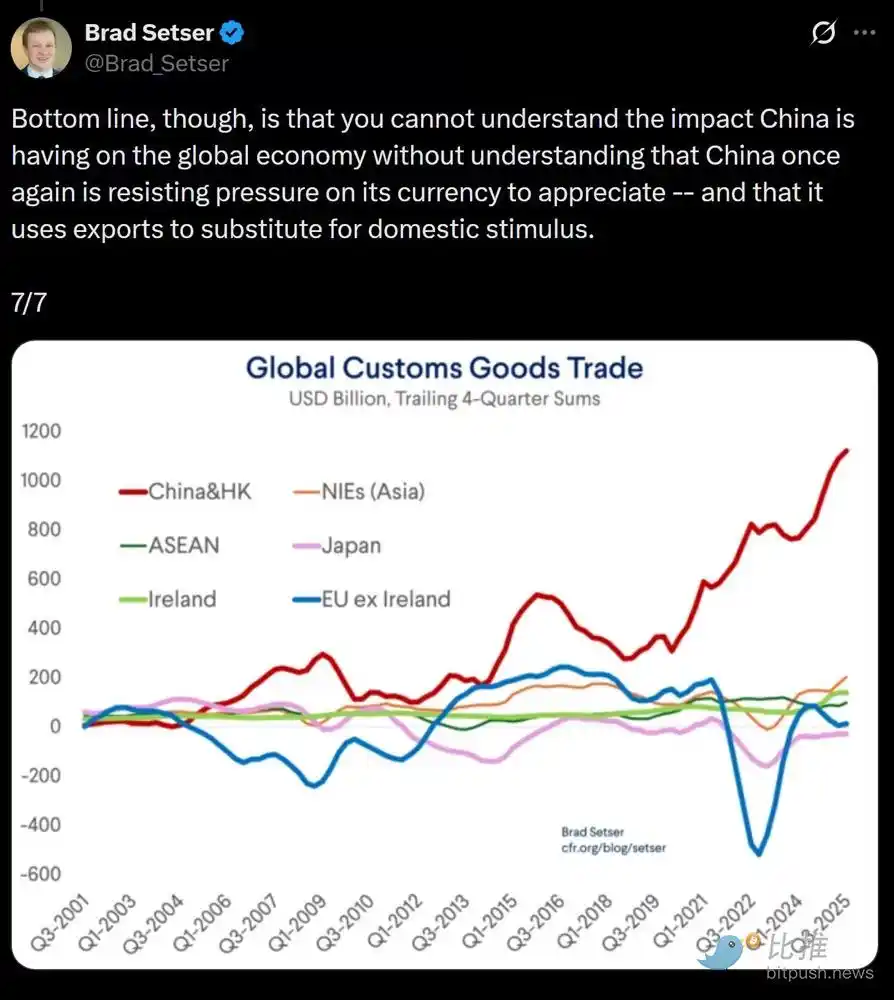

The core point is: China is artificially suppressing the value of the Renminbi (providing its export products with an artificial price advantage), while the U.S. dollar is artificially overvalued due to foreign capital inflows (resulting in relatively cheap import prices).

We believe that to address this structural imbalance, a mandatory devaluation of the U.S. dollar may be imminent. In our view, this is the only viable path to resolve the global trade imbalance.

In a new round of financial repression, the market will ultimately determine which assets or markets qualify as a "store of value."

The key question is, when all the dust settles, whether U.S. Treasury bonds can still play the role of a global reserve asset.

We believe that Bitcoin and other global, non-sovereign stores of value (such as gold) will play a far more significant role than they do now. The reason is that they are scarce and do not rely on any policy credit.

This is what we see as the "macro setup" being established.

You may also like

Why DePIN Is the Next Big Revolution in 2026-2028

Key Takeaways DePINs have emerged as a vital solution to the infrastructural demands of AI, moving from theoretical…

Massive US Storm Forces Bitcoin Miners Offline – What Does That Mean for Bitcoin Holders?

Key Takeaways A severe Arctic storm in the U.S. has significantly impacted Bitcoin mining operations, resulting in substantial…

7 Best Crypto Lightning Network Wallets in 2026: Evaluated & Ranked

Key Takeaways Lightning Network wallets enable fast and cost-effective Bitcoin transactions by using off-chain channels. A variety of…

Solana Price Prediction: Institutions Just Chose SOL Over BTC, ETH, and XRP – Is This the Beginning of a Massive Flippening?

Key Takeaways Institutional investors are increasingly favoring Solana over traditional giants like Bitcoin (BTC), Ethereum (ETH), and XRP.…

Penguin Meme Coin Surged 18,000% After Viral White House Post

Key Takeaways: The Penguin meme coin, known by its ticker PENGUIN, experienced a massive surge in market capitalization…

XRP Price Prediction: XRP Ledger Blasts Past $2 Billion in Tokenized Assets – Why This Could Catapult XRP Parabolic

Key Takeaways XRP Ledger’s (XRPL) tokenized assets have surged past $2 billion, cementing its position in both traditional…

Dogecoin Price Forecast: Impending Developments Could Determine DOGE’s Future

Key Takeaways Dogecoin price momentum has stalled, placing it at a critical juncture between recovery and further losses.…

Shiba Inu Price Prediction: Over 250 Billion SHIB Withdrawn – Are We Hours Away From a Surprise Rally?

Key Takeaways Significant SHIB withdrawals signal potential bullish trends, with over 250 billion tokens moved from exchanges to…

Elon’s Grok AI Predicts the Price of XRP, Solana, and PEPE by the End of 2026

Key Takeaways Grok AI, a project rivaling ChatGPT, provides optimistic forecasts for the future prices of XRP, Solana,…

Pump.fun ($PUMP) Price Prediction 2026, 2027 – 2030

Pump.fun has launched its $PUMP token in a much-anticipated ICO, quickly reaching a $2 billion market cap. The…

Is SOL Prepared for a New All-Time High? Solana Captures Nearly Half of Blockchain Activity in Current Bull Run

Key Takeaways: Solana has become a dominant force in the blockchain space, handling nearly half of all blockchain…

XRP (XRP) Price Prediction 2026, 2027 – 2030

Key Takeaways XRP’s price is predicted to fluctuate between $2.05 and $2.32 in 2026, potentially reaching between $3.23…

XRP Price Prediction: How the October 18-25 SEC Deadlines Could Induce a Breakout

Key Takeaways: The approaching October 18-25 SEC deadlines for spot XRP ETF applications could significantly impact XRP’s market…

Best Crypto to Buy Now January 23 – XRP, Dogecoin, PEPE

Key Takeaways Regulatory Shifts: U.S. crypto regulation is becoming inevitable, affecting investment outlooks, especially for altcoins. XRP Developments:…

Ethereum Price Prediction: Ethereum Developers Prepare for Quantum Computers – Major Update on the Horizon?

Key Takeaways The Ethereum Foundation has initiated a post-quantum security team to counteract threats posed by future quantum…

XRP Price Prediction: Institutional On-Ramp Commences in October – Can XRP Rise as Wall Street’s Next Favorite?

Key Takeaways Institutional interest in XRP derivatives is on the rise, suggesting a promising future for the cryptocurrency.…

6 Leading Decentralized Prediction Markets Without KYC in 2026

Key Takeaways Decentralized prediction markets enable users to speculate on various real-world events without intermediaries, offering freedom from…

8 Most Expensive Cryptocurrencies by Price in 2026

Key Takeaways Bitcoin remains the most expensive cryptocurrency as of January 2026, valued at $88,877.30 per coin, highlighting…

Why DePIN Is the Next Big Revolution in 2026-2028

Key Takeaways DePINs have emerged as a vital solution to the infrastructural demands of AI, moving from theoretical…

Massive US Storm Forces Bitcoin Miners Offline – What Does That Mean for Bitcoin Holders?

Key Takeaways A severe Arctic storm in the U.S. has significantly impacted Bitcoin mining operations, resulting in substantial…

7 Best Crypto Lightning Network Wallets in 2026: Evaluated & Ranked

Key Takeaways Lightning Network wallets enable fast and cost-effective Bitcoin transactions by using off-chain channels. A variety of…

Solana Price Prediction: Institutions Just Chose SOL Over BTC, ETH, and XRP – Is This the Beginning of a Massive Flippening?

Key Takeaways Institutional investors are increasingly favoring Solana over traditional giants like Bitcoin (BTC), Ethereum (ETH), and XRP.…

Penguin Meme Coin Surged 18,000% After Viral White House Post

Key Takeaways: The Penguin meme coin, known by its ticker PENGUIN, experienced a massive surge in market capitalization…

XRP Price Prediction: XRP Ledger Blasts Past $2 Billion in Tokenized Assets – Why This Could Catapult XRP Parabolic

Key Takeaways XRP Ledger’s (XRPL) tokenized assets have surged past $2 billion, cementing its position in both traditional…