From Panic to Reversal, BTC Surges to $93K: Has the Structural Turning Point Arrived?

Original Article Title: "BTC Returns to $93,000: Four Major Macro Signals Resonate, Crypto Market May Welcome a Structural Turning Point"

Original Article Author: Dingdang, Odaily Star Daily

Over the past 48 hours, the crypto market once again reminded everyone in an almost dramatic way: here, "plunges" and "bull returns" are always just a day's trading apart. BTC staged a strong rebound to near $93,000, with a 24-hour gain of close to 7%; ETH returned above $3,000; SOL also retested $140.

After the U.S. stock market opened, the crypto sector also showed a general rise. BitMine, an ETH treasury company, saw its stock price rise by 11.6% in 24 hours, and Strategy, the largest BTC corporate holder, saw a 6.2% increase.

In terms of derivatives, the total liquidation amount in the past 24 hours reached $430 million, with long liquidations totaling $70 million and short liquidations totaling $360 million. The main liquidation was a short position, and the largest single liquidation occurred on Bybit - BTCUSD, with a position value of $13 million.

In terms of market sentiment, according to Alternative.me data, today's cryptocurrency fear and greed index has risen to 28, still in the "fear" zone, but compared to yesterday's 23 (extreme fear), sentiment has clearly improved, and the market is showing signs of a slight recovery.

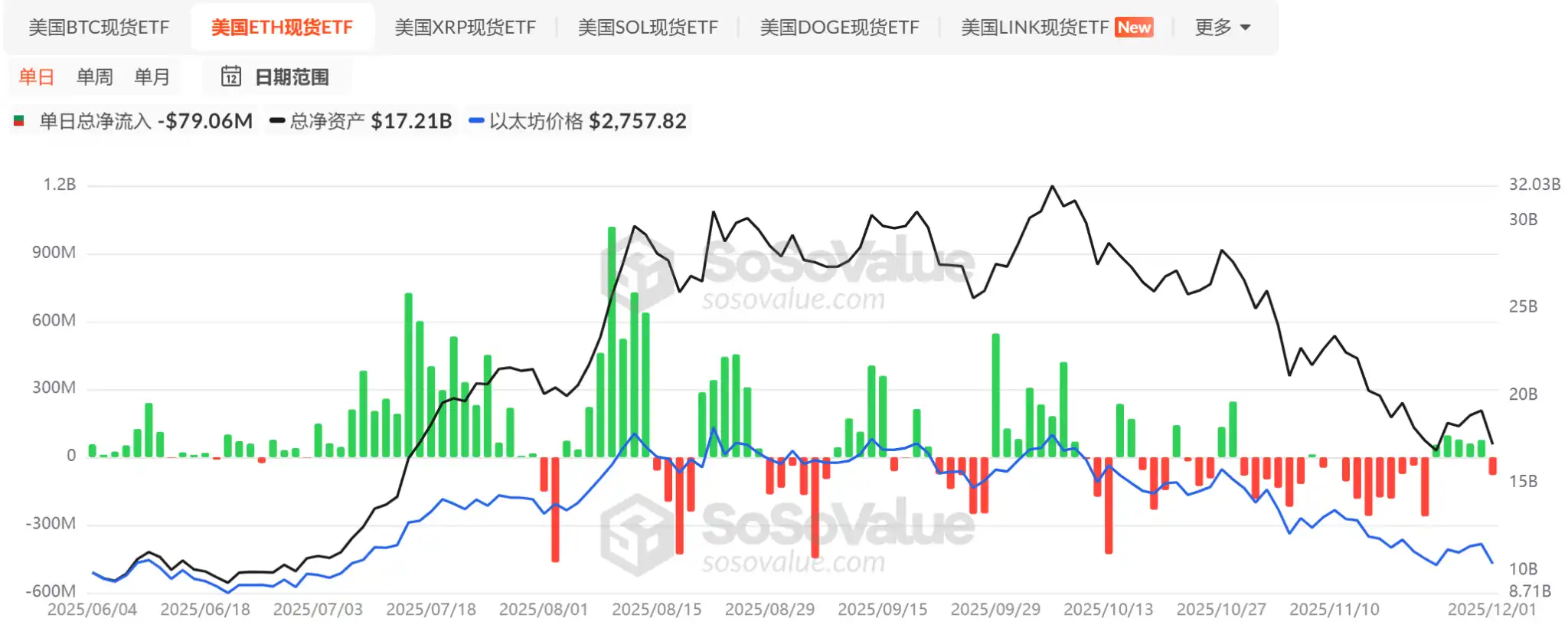

Regarding fund inflows, according to sosovalue.com data, after BTC spot ETFs experienced intense outflows for four consecutive weeks, they finally saw modest inflows for four consecutive trading days; ETH spot ETFs, on the other hand, turned into net outflows of $79 million after five consecutive inflows. Overall, the current momentum of fund inflows is still relatively weak.

Meanwhile, altcoin ETFs have accelerated their approvals under policy dividends, with XRP, SOL, LTC, DOGE, and other ETFs being listed intensively. Among them, although the XRP ETF was later than the SOL ETF, its performance was even more remarkable. Its current total net inflow has reached $824 million, surpassing the SOL ETF, and in the short term has become the "institutional representative work" of altcoins.

Superficially, the recent surge in the crypto market seems to lack a significant direct catalyst, but in reality, forces beneath the surface are synchronously building up──from rate expectations to liquidity inflection, and to the restructuring of institutional allocation logic, each is potent enough to steer the market direction.

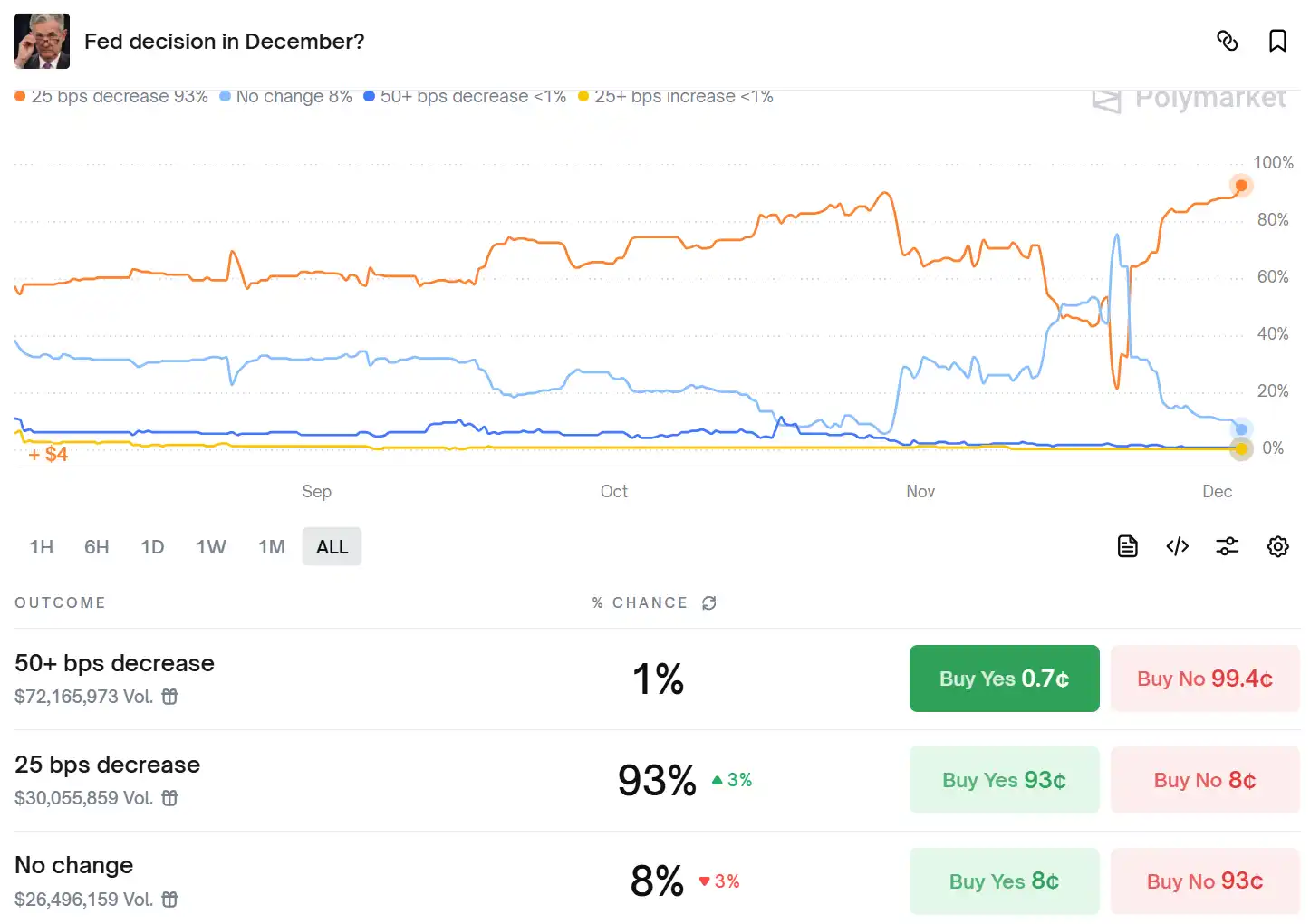

Forecast Reversal: December Rate Cut Appears Set in Stone

Analysts at Goldman Sachs' Fixed Income, Currency, and Commodities (FICC) division believe that an interest rate cut by the Federal Reserve at the upcoming December meeting has essentially become a done deal. Similarly, Bank of America's Global Research division indicates that due to the soft labor market conditions and recent hints from policymakers suggesting an early rate cut, they now expect the Fed to cut rates by 25 basis points at the December meeting. This is a shift from the bank's previous expectation of the Fed maintaining rates at the December meeting. At the same time, the bank currently forecasts rate cuts of 25 basis points each in June and July 2026, bringing the final rate to a range of 3.00%-3.25%.

Polymarket data shows that the probability of the Fed cutting rates by 25 basis points next week has risen to 93%, with the total trading volume in this prediction pool reaching $300 million.

Liquidity Shift: QT Conclusion and $135 Billion Infusion

A more crucial signal comes from the Federal Reserve's balance sheet operations. Quantitative Tightening (QT) officially concluded on December 1, having previously withdrawn over $2.4 trillion in liquidity from the system, stabilizing the Fed's balance sheet around $6.57 trillion.

Of more significance, on the same day, the Fed injected $135 billion in liquidity into the market through overnight repo tools, marking the second-largest single-day liquidity injection since the pandemic, aimed at alleviating short-term funding pressures in banks. However, this is not quantitative easing (QE) but rather temporary liquidity support.

Powell's Successor: Political Variable Before Christmas

Beyond liquidity and rates, another thread affecting market sentiment comes from politics. With Powell's term set to end in May next year, the search for the next Federal Reserve Chair has fully commenced, with five candidates currently vying for arguably the most crucial position in the U.S. economy. These contenders include Federal Reserve Governors Christopher Waller, Michelle Bowman, former Fed Governor Kevin Warsh, BlackRock's Rick Rieder, and NEC Director Haslett. U.S. Treasury Secretary Bassett, who oversees the selection process, stated last week that Trump may announce his nominee before the Christmas holiday.

Insiders say Trump trusts Hassett and believes he shares his desire for a more aggressive rate cut by the central bank. Hassett has indicated he would accept the position if offered.

Asset Management Giants Easing Up: Crypto ETF Officially Enters "Mainstream Wealth Management"

Over the past few years, traditional giants like Vanguard and Merrill Lynch have always kept their distance from crypto ETFs—not because they don't understand, but because they are "risk-averse." However, this week, as Vanguard and Merrill announced expanded client access to crypto ETFs and Charles Schwab planned to open Bitcoin trading in the first half of 2026, this landscape has finally started to loosen up.

Importantly, the style of traditional institutions has always been "prefer to miss out than step on a landmine." Their loosening grip is not a short-term trading signal but a long-term strategic shift. If the above institutions allocate just 0.25% of their funds to BTC, it also means there will be approximately $750 billion of structural incremental buying pressure in the next 12-24 months. Coupled with relaxed monetary conditions, 2026 is poised for strong growth.

Furthermore, one of the largest financial institutions in the U.S., Bank of America, has allowed wealth advisors to recommend allocating 1%-4% to crypto assets to clients starting from January 2025, with the initial recommended assets being IBIT, FBTC, BITB, and BTC—meaning BTC has officially entered the "standard allocation" list of traditional U.S. wealth management. This move aligns Bank of America's wealth management platform with major institutions like BlackRock and Morgan Stanley. For Wells Fargo and Goldman Sachs, which have been slow to act, industry pressure is rapidly mounting.

Conclusion

The rebound in this market is not solely driven by a single positive development, but more like multiple macro clues resonating at the same time: clear rate cut expectations, liquidity inflow, approaching political variables, and asset management giants easing up. More importantly, crypto assets are transitioning from "allowed to trade" to "acknowledged allocation," propelling them towards a more sustainable fund-driven cycle.

You may also like

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Hong Kong Enhances Gold Market Access Through Hang Seng Gold ETF and Tokenized Units

Key Takeaways: The Hang Seng Gold ETF offers Hong Kong investors direct access to gold by launching a…

XRP “Millionaire” Wallets Rise Despite Modest Price Dip: Santiment

Key Takeaways: The count of XRP wallets holding over 1 million tokens is increasing, despite a slight dip…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…

Crypto Price Prediction for January 28 – XRP, Solana, Bitcoin

Key Takeaways Bitcoin price recently hit $90,000 but struggled to maintain this peak. XRP and Solana are following…

Sygnum Bank Secures Over 750 BTC for Bitcoin Yield Fund’s Growth

Key Takeaways: Sygnum Bank has raised over 750 BTC in the initial phase of the Starboard Sygnum BTC…

Asia Market Open: Bitcoin Holds Steady Near $88K Amidst Asia’s Tech Slowdown and Gold Surge

Key Takeaways Bitcoin remains stable at nearly $88,000 as Asian tech markets show signs of cooling. Global markets…

SEC Warns Tokenization Is Not A Workaround For Securities Compliance

Key Takeaways: The U.S. Securities and Exchange Commission (SEC) emphasizes that tokenizing financial securities does not exempt them…

Dogecoin Price Prediction: DOGE Founder Reveals True Cause of Crypto Market Downturn

Key Takeaways: The recent downturn in the cryptocurrency market, including Dogecoin, is attributed to shifting investor behavior rather…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…