Crypto big shots spend a seven-figure sum on security each year, fearing a Blue Team incident.

Travel blogger Blue Zhanfei, who has over 20 million fans on TikTok, was robbed.

Blue Zhanfei is a familiar name in the short video community. Starting as a gaming streamer, he later shifted to travel content. With 26.63 million TikTok fans and a solid following on Weibo, he once joked in a livestream that if he took commercialization seriously, he could earn a nine-figure income annually.

While staying at a five-star hotel in South Africa, Blue Zhanfei was reportedly robbed at knifepoint by a Chinese national and two black individuals who seemed to have planned the attack six months in advance. After this incident went viral on social media, the crypto community, however, exhibited a familiar sense of "after-the-fact fear."

In recent years, from France to the UAE, from the US to South America, kidnapping cases targeting cryptocurrency holders have been on the rise. As assets are not tied to banks and can be easily transferred, coupled with the "digitally astonishing" wealth of crypto elites, they have become prime targets for certain criminal groups, rather than just "random victims." This also explains why the security budgets of crypto big shots are so high that even traditional businesses are astonished.

In the following content, join us to explore the security budgets of crypto big shots.

Coinbase CEO

In the crypto sphere, Coinbase CEO Brian Armstrong's security budget is likely among the top.

As disclosed in Coinbase's April 2025 annual proxy statement to the SEC, in 2024, Coinbase spent $6.2 million on personal security for Brian. Since 2020, Coinbase has allocated over $20 million in security expenses for him.

This means that Brian spends nearly $20,000 per day on security.

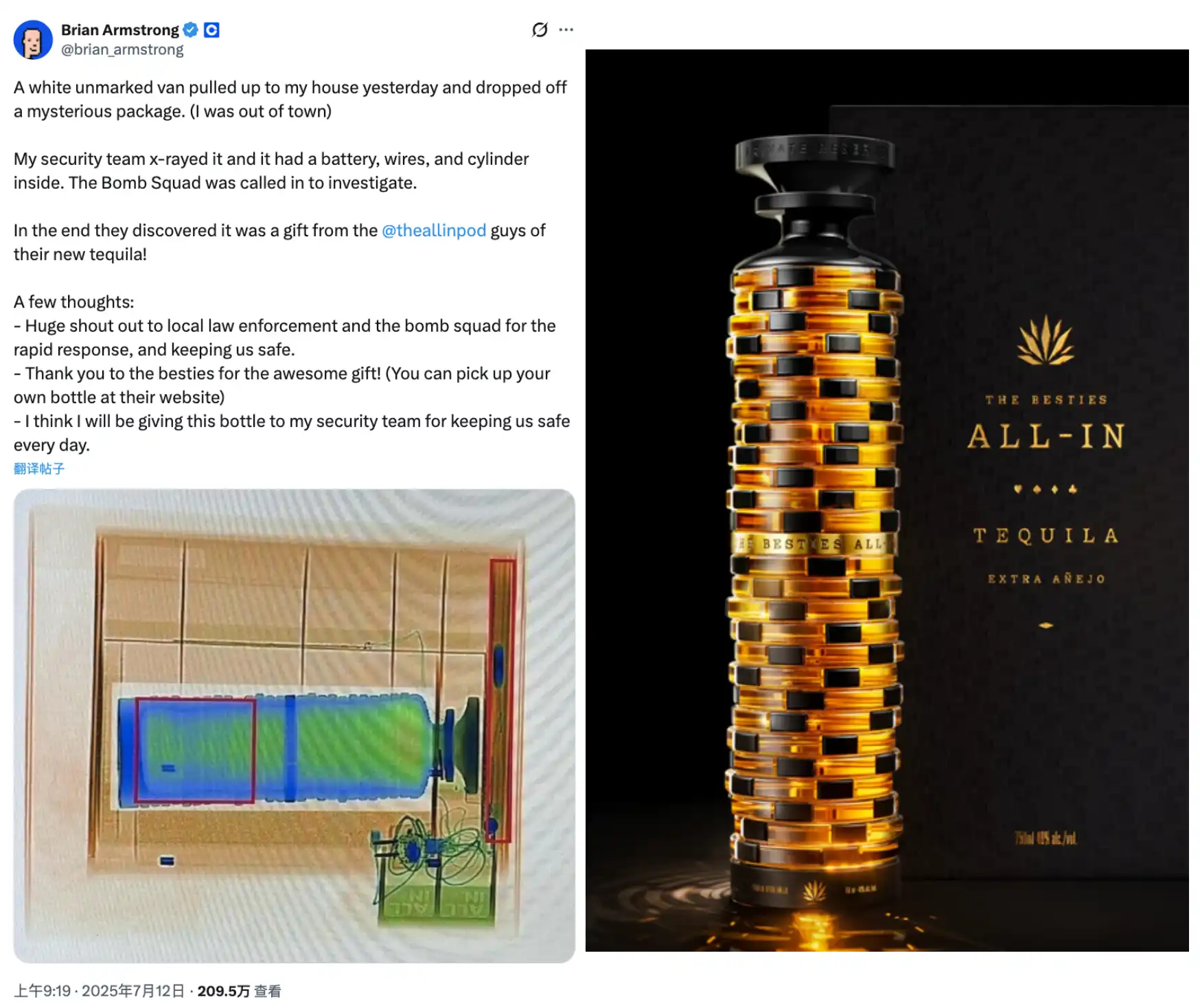

Brian's security measures are meticulous to the point of paranoia: they include certified armed guards, secure accommodation arrangements, and residential security measures. All packages delivered to Brian's residence must undergo X-ray screening, and if any suspicious items are found, the security team will immediately initiate bomb disposal procedures.

This stringent process underwent a dramatic "blunder" test on July 12, 2025.

On that day, Brian was not at home when an unmarked white truck delivered a package. When the security team conducted an X-ray inspection of the package following standard procedures, the screen displayed outlines of a battery, wires, and a cylindrical object, highly matching the typical construction of an improvised explosive device. The security personnel promptly contacted the local law enforcement, and the bomb disposal team swiftly arrived on the scene for further investigation.

After a careful inspection, the truth has come to light: the package actually contained a tequila gift box from The All-In Podcast (@theallinpod), and the battery and wires shown on the X-ray were actually part of the bottle's lighting mechanism design.

Although it was a misunderstanding, it inadvertently proved that Coinbase's $6.2 million annual security budget for Brian was indeed very useful.

Michael Saylor

As the "largest Bitcoin-holding company," Michael Saylor, Chairman of Strategy (formerly MicroStrategy), saw his security budget increase from $1.4 million to $2 million in October 2025.

This adjustment was made against the backdrop of a surge in 2024-2025 of violent incidents targeting corporate executives, including the assassination of the CEO of UnitedHealth Group and assaults on security personnel at Rudin Management Company.

In 2013, Michael Saylor's annual security expenditure was only $58,000, a figure that some investors questioned at the time, asking, "Why would a software company CEO spend so much money on bodyguards?" However, since starting a frenzied Bitcoin buying spree in 2020, the company had accumulated over 580,000 BTC by 2025. This significantly increased Saylor's personal risk level, leading to his security budget steadily rising to its current $2 million.

Today, when Saylor attends events, he is accompanied by a private bodyguard, an armed driver, and a private jet. In May and September 2025, netizens captured images of him "surrounded by bodyguards" at several Bitcoin bars in New York. Although the exact team size was not disclosed, according to a survey by Goldman Sachs Ayco, a standard setup for such executives typically includes at least one accompanying bodyguard and an armed driver.

Saylor also faces unique digital threats. In January 2024, his security team had to delete approximately 80 AI-generated deepfake videos daily. These videos impersonated Saylor promoting Bitcoin scams, luring users to scan QR codes to participate in fake "Bitcoin doubling" schemes. Saylor himself issued warnings on social media, stating, "There is no such thing as a risk-free Bitcoin doubling method... My team has to delete about 80 fake AI-generated YouTube videos every day... Don't trust, verify."

This ongoing digital threat, combined with physical security needs, explains why this Bitcoin billionaire requires such a massive security investment.

Vitalik Buterin

In stark contrast to Brian Armstrong and Saylor's high-profile security, Ethereum co-founder Vitalik Buterin's lifestyle epitomizes "contrast art."

Since gaining permanent residency in Singapore in 2023, he has been leading a minimalist life: renting an apartment in the Bukit Timah area for a monthly rent of about 5,000-7,000 Singapore dollars, taking the subway for transportation, working in cafes, and even hand-washing clothes to save a $4 laundry fee. Despite a net worth exceeding $1.1 billion, he blends in with the locals in the streets of Singapore, with no bodyguards or entourage.

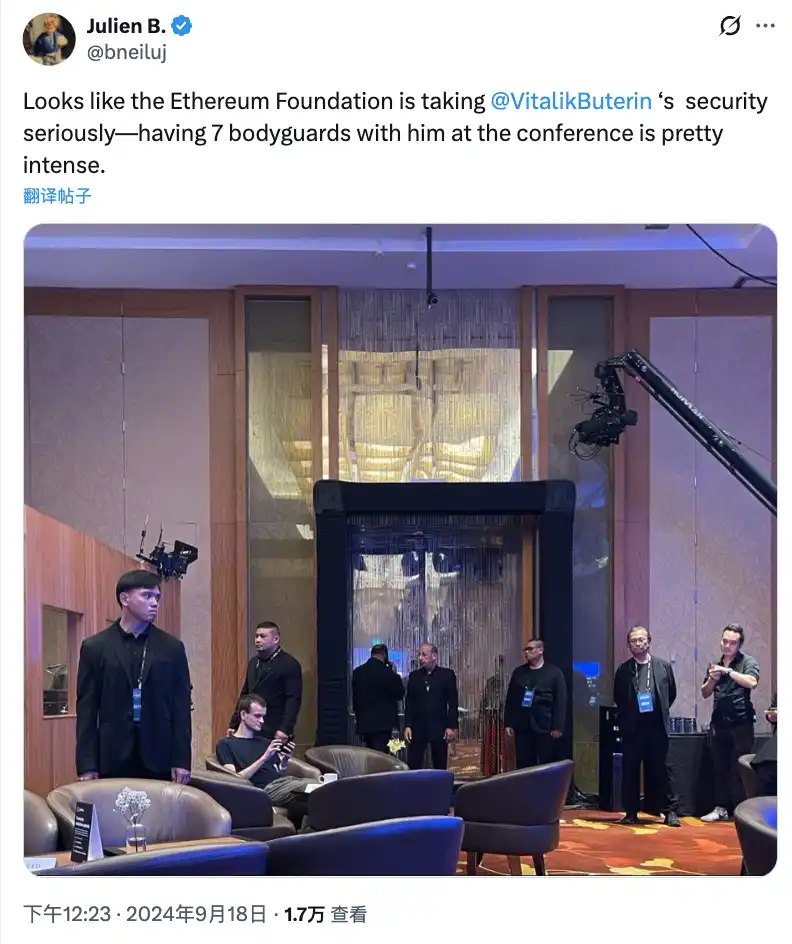

However, when attending events, the organizers usually arrange a security team for Vitalik to ensure his safety.

For example, during the Devcon-related events in Thailand in December 2024, Bodyguard VIP Thailand provided a customized personal security plan for various cryptocurrency VIPs, including Vitalik, equipped with top-notch local bodyguards. Additionally, in September 2024, a photo taken at a cryptocurrency conference showed Vitalik surrounded by several bodyguards and security measures.

But most of the time, Vitalik seems to be without visible bodyguards. For example, at the ETHCC conference held in Brussels in July 2024, Vitalik arrived alone on a bus in the rain, his clothes still wet during the speech, and left on foot after the event, without any accompanying security throughout.

The most significant threat Vitalik faces is also at the digital level. In 2023, he fell victim to a SIM card swap attack, which led to the reset of his Twitter password and the posting of a phishing NFT minting link. About $700,000 worth of assets was stolen from Vitalik's fans. This incident has led him to openly discuss the dangers of SIM card swap attacks to this day and remind users to remove their phone numbers from X account bindings.

Justin Sun

Known for his sometimes flashy behavior, Justin Sun's security detail is equally eye-catching, often accompanied by several burly bodyguards.

Especially during his visit to Hong Kong in June 2023, there was a substantial reward offered to slap Sun or throw eggs at him. In this context, Sun's four bodyguards who appeared with him sparked discussion among netizens, with one particularly fierce-looking and seemingly reliable bodyguard even being ranked first.

Later, Sun mentioned on social media that he had mistakenly thought this bodyguard was Filipino, only to discover he was actually Gurkha from Nepal, known for being part of one of the world's most famous mercenary systems.

Sun's awareness of security is also very advanced, not only in terms of physical security but also in how he protects the privacy of his wealth.

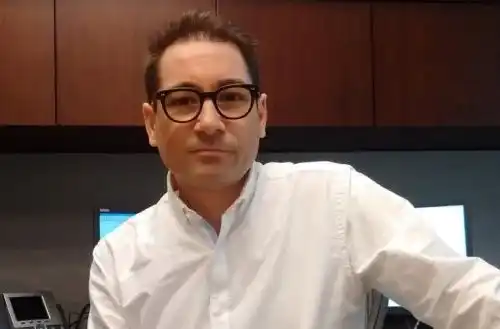

On August 11, 2025, Sun filed a lawsuit in the United States against Bloomberg for violating a confidentiality agreement while compiling the Billionaires Index, by disclosing detailed cryptocurrency holdings provided for wealth verification. Such detailed disclosure would increase the risks of "theft, hacking, kidnapping, and physical harm to himself and his family" through wallet clustering analysis. He even cited Bloomberg's own reports as court evidence: in 2025, there were 51 cases globally of cryptocurrency investors being violently coerced to surrender their private keys.

Changpeng Zhao

In contrast, security details about Binance founder CZ are less exposed.

It wasn't until the court judgment files in the United States in 2024 that some media outlets discovered, among 160 letters of support, a person named Xin Wang claiming to be an "old classmate" of CZ, calling himself CZ's friend in his youth and also his bodyguard. In the letter, Xin Wang recounted his acquaintance with Changpeng Zhao at McGill University, describing the young CZ as a "nerdy, bespectacled kid" who has now grown into an "elderly version" but retains his "quiet, pragmatic kindness."

This bodyguard is evidently not a typical security personnel. His colleague is the CEO of Bayview Acquisition Corp, providing mergers and acquisitions advice to financial institutions, holds legal qualifications to practice law in California, England, and Wales, and was appointed as an independent board member of Binance in April 2024. Such multiple roles are quite rare in the security field within the crypto industry.

Ethereum Early Co-founder Anthony

Another co-founder of Ethereum, Anthony Di Iorio, took a completely different security route from Vitalik, with a 24/7 security setup.

Perhaps because Anthony is a wealthy trust fund kid, or perhaps because as an early participant in Ethereum, his holding of ETH easily made him a high-value target, and the self-custody nature of cryptocurrency assets made traditional financial insurance unable to cover potential personal threats.

Therefore, since 2017, he has employed a private security team, with these security personnel accompanying Di Iorio wherever he goes or waiting at the destination. In 2018, Forbes estimated his net worth to be between 7.5 billion and 10 billion US dollars, placing him in the top 20 richest people in the cryptocurrency field. That year, he purchased Canada's most expensive apartment for $22 million, a three-story penthouse, partly paid for using cryptocurrency, causing quite a stir.

So, in 2018, it seems that his security team also increased their budget, with witnesses observing him traveling with a "small entourage, including bodyguards," a 24/7 security setup that lasted until his retirement from the industry.

In 2021, he announced his decision to "sell off" and retire from the industry based on personal security and other considerations, no longer funding any blockchain projects. At that time, he admitted, "I do not feel safe in this industry... If I focus on bigger problems, I think I'll be safer."

He then sold his company Decentral, severed major ties with blockchain startups, and shifted his focus to charitable causes to avoid being labeled as a "crypto person."

Circle CEO

Circle's CEO Jeremy Allaire manages the $780 billion market cap USDC stablecoin and a $200 billion publicly traded company, making him a key figure in cryptocurrency financial infrastructure.

According to Circle's S-1 IPO filing submitted on April 1, 2025, the company invested $800,000 in personal security for Allaire in 2024.

In the year when multiple "crypto kidnapping" cases occurred in France, Dubai, Argentina, and other places, this amount did not seem exaggerated. Several reports cited Circle's IPO prospectus to confirm this number.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…