Blockworks Research: As Ethereum recovers, what opportunities and challenges will Based Rollup bring?

Original author: Donovan Choy

Original translation: TechFlow

Ethereum loves Rollup. Recently, "based" Rollup has attracted much attention.

What is special about based Rollup? The core lies in its sequencer.

Traditional Layer-2 uses a centralized sequencer to process user transactions and submit them to Layer-1 for settlement, while based Rollup entrusts the sequencing task to the validators of Ethereum Layer-1. This mechanism is called "based sequencing".

This design has two major advantages: anti-censorship and enhanced interoperability.

By letting Layer-1 act as a sorter, Rollup based on Ethereum can provide the same liveness guarantees as the Ethereum mainnet while avoiding the censorship issues that may arise from a centralized sorter.

Read more: MagicBlock Open Sources a16z-supported "Short-lived Rollup" technology

Another important advantage is a significant increase in interoperability. Based on Rollup supporters (such as Justin Drake) call it " synchronous composability", that is, transactions on Ethereum can be synchronously ordered or bridged between different Layer-2.

In simple terms, smart contracts on a Rollup based on Ethereum can call other contracts on Layer-1 almost instantly within the same block, as if they were all on the same chain.

This synchronization and the idea of "money legos" is not new; it has always been an important part of Ethereum's original vision.

Read more: Rethinking Ethereum Consensus with Beam Chain

However, the current decentralized state of Rollup causes transactions between Arbitrum and Optimism to be asynchronous, which introduces uncertainty in fees. This uncertainty is further exacerbated by the fact that gas fees are calculated at different points in time, rather than uniformly calculated within the 12-second time slot of Ethereum blocks.

In addition to making Ethereum more interoperable, this mechanism also brings significant cost savings. Ahmad Mazen Bitar, technical lead at Nethermind, explained:

"Users can initiate a transaction on Layer-1, complete the operation using the deep liquidity pool of Layer-2, and then return to Layer-1. This synchronous composability makes the whole process more efficient."

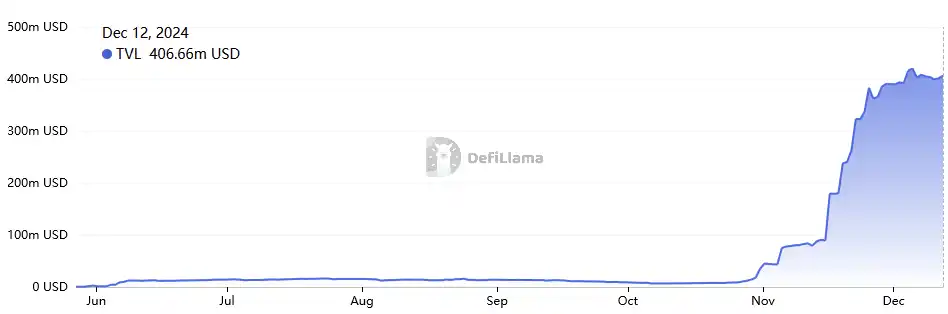

Currently, the largest based Rollup is Taiko, which has seen significant growth in both its TVL and daily transaction volume this month.

Source: DefiLlama

Other early based Rollup projects are also under development, such as Surge by the Nethermind team and UniFi by the Puffer Finance team. These projects are all based on the Taiko fork.

Nevertheless, based Rollup also faces some challenges. Since the sorting task is handed over to the Layer-1 validators, its performance is limited by the 12-second block time of Layer-1.

Therefore, the advantages of based Rollup (such as synchronous composability) may be difficult to fully realize in practice. It requires real-time zero-knowledge proofs to be completed within a 12-second time slot, otherwise composable transactions cannot be executed quickly.

To this end, Taiko introduced a variety of technologies, including zk proofs from Risc Zero and Succinct Labs, and a trusted execution environment (TEE) based on Intel SGX. This makes Taiko the first based Rollup to implement multiple proofs in a production environment without relying on a single trusted party.

"The performance of the prover is improving rapidly. We see more trusted execution environments (TEEs), more efficient and lower-cost zero-knowledge virtual machines (zkVMs), and verifiable state machines (AVSs) being introduced. We believe that the progress of zk technology is very smooth, and the goal of generating proofs within sub-time slot delays is not far away," said Brecht Devos, co-founder of Taiko, in an interview with Blockworks.

However, based Rollup also faces some challenges. For example, without a centralized sorter, an important source of revenue, MEV (maximum extractable value), may be lost. However, Devos said that this problem can be solved in some innovative ways.

In the Taiko network, "MEV can be captured by auctioning 'execution tickets' to Layer-1 block proposers," Devos explained to Blockworks.

So while Rollup based on staking gives ordering rights to Layer-1 validators by default, this is not the only solution.

Matthew Edelen, co-founder of Spire Labs, a company focused on Rollup infrastructure, shared a similar sentiment in a recent Bell Curve podcast: "Auctions are not the only way to allocate ordering rights. We can allocate 99% of ordering rights through auctions while allocating the remaining 1% to friends or independent stakers to present a better image on L2Beat."

In the long run, MEV (maximum extractable value) may not be a major problem. This view stems from a simple cost-benefit analysis: currently, most of the blockchain's revenue comes from congestion fees, which far exceeds the revenue of MEV. Moreover, as more efficient MEV solutions continue to emerge, the proportion of MEV revenue is gradually decreasing.

Therefore, for Rollup, a better revenue model is to rely on the network effect brought by synchronous composability and benefit from congestion fees rather than relying on MEV charges.

As Justin Drake said in The Rollup podcast:

“Right now, the ratio of congestion fees to contention fees is about 80:20. Of the revenue on Ethereum mainnet (Layer-1), 80% comes from congestion fees - about 3,200 ETH per day since the implementation of EIP-1559. Since the merger, MEV revenue has been about 800 ETH per day. I think this ratio will become more disparate, perhaps from 80:20 to 99:1.”

To sum up, the advantages of Based Rollup bring Ethereum’s user experience back to its original state.

Interestingly, this return is actually reminiscent of the characteristics that blockchain has had since its inception. Synchronous composability and Layer-1 transaction ordering have been core features of blockchain since the birth of the Bitcoin network.

This divergence of execution layer responsibilities is largely due to the centralized development path of Rollups in recent years (as well as the multi-chain architectures of Polkadot, Cosmos, and Avalanche). Today, Rollup-based solutions are ready to recapture this original intention.

「Original source」

You may also like

AI Trading Hackathon 2026: Win $1.88M Prize Pool with CoinGecko API (Live Market Data)

One hackathon. Two opportunities. Builders can now win the CoinGecko API track while sharpening their AI trading edge with data-driven strategies in the $1.88 million main competition.

a16z-Backed Crypto Custody Startup to Close, Returning Investor Capital

Key Takeaways Entropy, a decentralized crypto custody startup, is closing its doors after four years due to strategic…

![[LIVE] Crypto News Today: Latest Updates for Jan. 23, 2026 – BTC Slides Below $90K as Crypto Market Extends Broad Sell-Off](https://weex-prod-cms.s3.ap-northeast-1.amazonaws.com/medium_21_2c30f7df62.png)

[LIVE] Crypto News Today: Latest Updates for Jan. 23, 2026 – BTC Slides Below $90K as Crypto Market Extends Broad Sell-Off

Key Takeaways The crypto market is in a downward trend, with GameFi, AI, and RWA sectors showing some…

Solana Price Prediction: 200+ U.S. Stocks Just Landed on SOL – Is This the Most Bullish News of the Year?

Key Takeaways: Solana has integrated over 200 tokenized U.S. stocks and ETFs, enhancing its status as the preferred…

XRP Price Prediction: $1.88 Triple-Bottom Support Amid ETF Money Pull Back – Analyzing Future Directions

Key Takeaways XRP currently stabilizes around $1.88 with triple-bottom support after recent price slips below $2.00. Institutional ETF…

CZ Declares He Won’t Return to Binance After Trump Pardon – What’s Going On?

Changpeng Zhao (CZ) has confirmed he will not return to Binance following his presidential pardon from Donald Trump.…

Crypto Price Prediction Today 22 January – XRP, Solana, Sui

Key Takeaways XRP Price Outlook: XRP remains in a fragile state within a descending channel, with the $1.80…

Cryptocurrency Price Prediction Today 23 January – XRP, Bitcoin, Ethereum

Key Takeaways Bitcoin, Ethereum, and XRP are in distinct phases of consolidation or resistance, with potential for significant…

Ethereum Launches $2M Quantum Defense Team as Threat Timeline Accelerates

Key Takeaways Ethereum has prioritized quantum resistance by establishing a dedicated Post Quantum (PQ) team, allocating $2 million…

Bitcoin & Ethereum ETFs Shed Over $1Billion, Solana and XRP Attract Inflows

Key Takeaways Bitcoin and Ethereum ETFs experienced substantial outflows exceeding $1 billion in just one day, reflecting a…

Ethereum Price Prediction: $3,000 Rejected, But On-Chain Data Reveals a Different Outlook

Key Takeaways Despite the recent price dip, Ethereum’s network fundamentals remain robust and are a strong indicator of…

Shiba Inu Price Prediction: SHIB Team Asserts ‘We’re Not Done Yet’ – Is a Parabolic Move Imminent?

Key Takeaways: Shiba Inu core members suggest the current market cycle may not be complete, hinting at potential…

Solana Price Prediction: Why $126 Could Be the Calm Before SOL’s Next Surge

Key Takeaways Solana’s price hovers around $126, showing signs of stability despite a recent pullback, as traders remain…

XRP Price Prediction: When Traders Get This Quiet, XRP Has a History of Going Wild – Is It About to Happen Again?

Key Takeaways XRP’s Market Quietness as Bullish Signal: Historically, a decrease in trading interest has often been a…

Ethereum Price Prediction: Wall Street Giant BlackRock Embraces Ethereum as Financial Infrastructure – Could ETH Embody the Internet of Money?

Key Takeaways BlackRock sees Ethereum as a cornerstone of future financial systems, positioning it as a leading digital…

Bitcoin Price Prediction: Rich Dad Poor Dad Author Kiyosaki Shrugs Off Price Crash – Here’s Why He’s More Optimistic Than Ever

Key Takeaways Robert Kiyosaki, author of “Rich Dad Poor Dad,” remains bullish on Bitcoin despite recent price fluctuations.…

XRP Price Prediction: XRP Approaches Accumulation Breakout with $1.85 Support as Bullish Targets Eye $4

Key Takeaways XRP’s long-term price indicators suggest a major accumulation phase, maintaining critical support around $1.85. The restoration…

XRP Price Outlook: Steady Gains Amid ETF Revival – Are Whales Ahead of the Curve?

Key Takeaways XRP-linked exchange-traded funds (ETFs) have resumed accumulation after a brief market dip. The resurgence of ETF…

AI Trading Hackathon 2026: Win $1.88M Prize Pool with CoinGecko API (Live Market Data)

One hackathon. Two opportunities. Builders can now win the CoinGecko API track while sharpening their AI trading edge with data-driven strategies in the $1.88 million main competition.

a16z-Backed Crypto Custody Startup to Close, Returning Investor Capital

Key Takeaways Entropy, a decentralized crypto custody startup, is closing its doors after four years due to strategic…

[LIVE] Crypto News Today: Latest Updates for Jan. 23, 2026 – BTC Slides Below $90K as Crypto Market Extends Broad Sell-Off

Key Takeaways The crypto market is in a downward trend, with GameFi, AI, and RWA sectors showing some…

Solana Price Prediction: 200+ U.S. Stocks Just Landed on SOL – Is This the Most Bullish News of the Year?

Key Takeaways: Solana has integrated over 200 tokenized U.S. stocks and ETFs, enhancing its status as the preferred…

XRP Price Prediction: $1.88 Triple-Bottom Support Amid ETF Money Pull Back – Analyzing Future Directions

Key Takeaways XRP currently stabilizes around $1.88 with triple-bottom support after recent price slips below $2.00. Institutional ETF…

CZ Declares He Won’t Return to Binance After Trump Pardon – What’s Going On?

Changpeng Zhao (CZ) has confirmed he will not return to Binance following his presidential pardon from Donald Trump.…