How to Update Your WEEX Profile Information

Ensuring your WEEX profile details are current is vital for account safety, seamless transactions, and an improved user experience. Whether you’re updating your email, phone number, or other personal information, this guide will lead you through each step.

Why Keeping Your Profile Updated Is Essential

Accurate profile information supports:

Account Protection – Reduces the risk of unauthorized access.

Efficient Transactions – Facilitates smooth deposits, withdrawals, and trading.

Improved Support – Simplifies identity verification for customer assistance.

Guide to Updating Your WEEX Profile

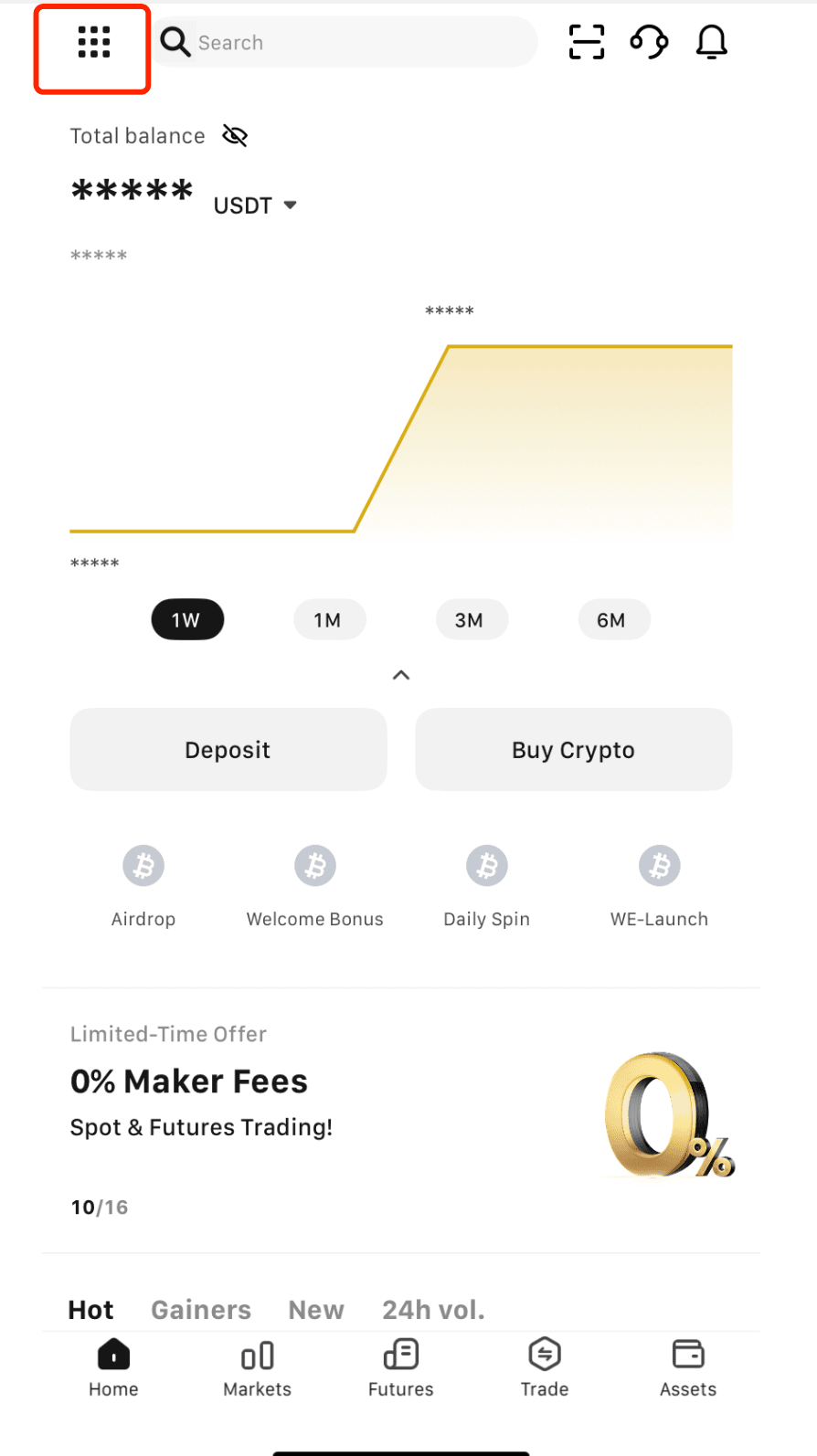

Step 1: Sign Into Your WEEX Account

Navigate to the official WEEX website and click the “Login” button.

Enter your login credentials to access your account.

Step 2: Access Profile Settings

Click your profile icon in the top-left corner of the homepage.

Choose “Account Settings” from the dropdown menu.

Step 3: Modify Profile Details

You can edit the following:

Login Password – Update your password periodically for enhanced security.

Mobile Number – Connect a valid phone number to strengthen account safeguards.

Email – Change your email address (you may need to verify the new email).

Google Authentication – Adjust settings for Google Authenticator to ensure secure access.

Two-Factor Authentication (2FA) – Activate or update 2FA for added protection.

Step 4: Confirm Your Updates

WEEX may send a verification code to your email or phone for security. Input the code to finalize your changes.

Security Tips for Profile Updates

Create a Strong Password – Use a mix of uppercase, lowercase, numbers, and symbols.

Activate 2FA – Add an extra security layer to block unauthorized access.

Protect Your Email – Keep your email secure, as it’s critical for account recovery.

Conclusion

Updating your WEEX profile is a quick and important task to maintain account security and ensure smooth trading. Regularly review and refresh your details to stay protected from potential risks.

For further assistance, contact WEEX Support.

You may also like

WEEX Labs: Is the Much-Hyped “Supercycle” Finally Upon Us?

“ABC: Anything But Crypto.”

As 2026 kicks off, this cynical mantra echoes through the trading floors. While gold and silver are in the pink, hitting record highs, Bitcoin is feeling blue, languishing near $90,000 in a sluggish retracement. Altcoins, meanwhile, are trapped in a seemingly endless sea of red.

Yet, against this backdrop of local despair, the elite at the Davos World Economic Forum are singing a different tune. The buzzword of the hour is the “Supercycle.” The argument? Regulatory thaws and mass adoption will soon act as a bulkhead against macro headwinds, ushering in a permanent bull market.

But what does this “Supercycle” actually entail? Is it a genuine paradigm shift, or just another high-octane narrative designed to part fools from their money?

Decoding the “Supercycle”

In the crypto lexicon, a “Supercycle” isn’t just a fancy term for a "pump." It refers to a prolonged expansionary phase driven by structural demand rather than fleeting hype—a cycle that lasts longer and climbs higher than anything we've seen before.

It marks crypto’s “coming of age,” moving from a fringe “digital experiment” to the “institutionalized” core of global financial infrastructure.

This isn't exactly a new vintage. In early 2021, Su Zhu (of the now-infamous Three Arrows Capital) championed the Supercycle theory, citing imminent mass adoption. Analysts like Dan Held echoed this, suggesting the 4-year halving cycle was merging with a larger 10-year macro wave. More recently, Murad Mahmudov ignited the “Meme Coin Supercycle” narrative, picking “winners” like SPX6900 to “mint billionaires.”

History shows that the “Supercycle” is often a marketing Trojan horse used to keep the party going. Is there any hard evidence that this time is actually different?

For a decade, crypto lived by a rhythmic "heartbeat"—the four-year halving cycle (three years of green candles, one year of red ink). Today, many believe that rhythm is being replaced by a sustained roar. The logic? We’ve shifted from Supply Scarcity to Demand Explosion.

The Regulatory Green Light: The US SEC’s decision to scrub “Crypto Assets” from its 2026 priority risk list is a watershed moment. CZ views this pivot from “suppression” to “compliance” as the starting pistol for the Supercycle.The Fundamental Facelift: Crypto is no longer just about “magic internet money.” With the globalization of stablecoins, prediction markets, and RWA (Real World Assets), the industry is merging with reality. Tom Lee argues that Ethereum is the poster child for this, evolving from “programmable money” into the “Global Settlement Layer.”Wall Street’s "Manifest Destiny": In previous cycles, we relied on retail "moonboys." Now, the Old Guard is building the architecture. BlackRock CEO Larry Fink isn’t just interested in Bitcoin; he wants to tokenize every financial asset on earth. This sovereign-level buy-in carries more weight than any halving ever could.The Interest Rate "Inverse Dividend": Paradigm’s Matt Huang offers a counter-intuitive take: the end of "free money" actually fueled the Stablecoin Supercycle. High interest rates allowed issuers to harvest massive yields, pumping liquidity back into the ecosystem’s veins.The Real Alpha: A "Structural" Rather than "Universal" Supercycle

While the "Supercycle" debate lacks a total consensus, we believe the era of “a rising tide lifts all boats” is over. A universal, moon-shot rally for every token on the board is unlikely to return.

The reason is simple: Crypto has moved into the "Big House" (Institutionalization). The market is now tethered to the Fed’s whims, global liquidity, and geopolitical tremors. With the yen carry trade unwinding and Quantitative Tightening (QT) sucking the oxygen out of the room, a total market explosion is a tall order. We must also brace for the occasional “1011-style” deleveraging crash when the market gets too over-leveraged.

However, a Structural Supercycle is already underway. The "Alpha" of the next few years will be found in sectors with tangible utility:

The "Plumbing" Revolution (Stablecoins): Stablecoins have become the essential "pipes" of global finance. We expect over 100,000 payment systems to emerge, forcing traditional banks to overhaul their legacy stacks.The Financialization of Information (Prediction Markets): Platforms like Polymarket (and Robinhood’s entry) are turning information into a tradable commodity. By pricing the probability of everything from elections to tech breakthroughs, they are becoming a multi-trillion-dollar gateway.The AI-On-Chain Synergy: AI agents don’t have bank accounts; they have wallets. The demand for permissionless, automated settlement layers will provide a "utility floor" for the market that is far more durable than mere speculation.The Supercycle is crypto’s Bar Mitzvah. It signals the dampening of wild volatility and the end of "easy mode" gains. The "ABC" noise is merely a transient fog. For those focusing on the builders and the infrastructure, the real cycle hasn't even reached its peak. The value will follow the utility. Stay tuned.

About Us

WEEX Labs is the research department established by WEEX exchange, dedicated to tracking and analyzing cryptocurrency, blockchain technology, and emerging market trends, and providing professional assessments.

We adhere to the principles of objectivity, independence, and comprehensiveness in our analysis. Our aim is to explore cutting-edge trends and investment opportunities through rigorous research methods and cutting-edge data analysis, providing the industry with comprehensive, rigorous, and clear insights, and offering all-round guidance for Web3 startups and investors in their development and investment.

Disclaimer

The views expressed herein are for informational purposes only and do not constitute endorsements of any discussed products or services, nor investment, financial, or trading advice. Readers should consult qualified professionals before making any financial decisions. Please note that WEEX Labs may restrict or prohibit all or part of its services in restricted jurisdictions.

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For investors searching "what is Boundless (ZKC)", it's essential to understand it's more than just a token. Boundless (ZKC) is a decentralized protocol that provides zero-knowledge (ZK) proof generation services to blockchain networks. Its core mission is to solve scalability and interoperability issues by offloading complex, computationally heavy verifications off-chain, allowing blockchains to operate faster and cheaper.

Unlike many speculative tokens, ZKC is built on tangible technology, specifically leveraging RISC Zero's zkVM. This positions it as a crucial piece of Web3 infrastructure, akin to a "utility company" for the blockchain world, where projects pay for verification services rather than relying on hype for value.

How Boundless (ZKC) WorksThe Core Protocol: On-Chain Proof VerificationBoundless distinguishes itself by operating an on-chain, trust-minimized marketplace for ZK proofs. Developers can request provable computations directly through smart contracts. Provers (network participants with computing power) then generate the proofs and are paid in ZKC tokens for their work. This model replaces slower, less secure methods like fraud-proof "challenge games" used by some rollups, reducing finality times from days to mere hours.

Key Utility & Use CasesThe ZKC token is the lifeblood of this ecosystem with clear utilities:

Payment for Services: Blockchains, rollups, and dApps use ZKC to pay for proof generation.Prover Incentives: Individuals contribute computational resources to earn ZKC rewards.Governance: Token holders will likely guide the future development of the protocol.Boundless (ZKC) Price Prediction 2026Given its technical foundation, a "Boundless (ZKC) price prediction" must balance utility potential with current market volatility. As of early 2026, ZKC trades around $0.16 with a market cap near $36 million, but exhibits extremely high trading volume, indicating strong speculative interest.

2026 Price Forecast Scenarios:

Bearish Scenario ($0.09 - $0.12): Triggered by broader crypto market downturns, delayed adoption, or significant token unlocks from early backers leading to sell pressure.Base / Consolidation Scenario ($0.15 - $0.25): The protocol sees steady but modest growth in partnerships and usage. Price stabilizes as utility begins to offset pure speculation.Bullish Scenario ($0.30 - $0.40+): Requires massive adoption catalysts, such as major Layer 2 rollups (e.g., Arbitrum, zkSync) integrating Boundless for their proof needs, validating its technology at scale.Analyst Note: ZKC's extremely high volume-to-market-cap ratio (often over 1000%) signals both high liquidity and high-risk speculative trading. Long-term price sustainability will depend almost entirely on real-world adoption and revenue generation, not just exchange activity.

Is Boundless (ZKC) a Good Investment?The question "Is ZKC a good investment" hinges entirely on your investment profile and belief in ZK technology.

Potential Upsides (The Bull Case):

Real Utility: Possesses a clear, revenue-generating business model in a high-growth sector (blockchain scalability).First-Mover Advantage: Early mover in the specialized field of decentralized ZK proof networks.Strong Backing: Built on respected technology (RISC Zero) and has attracted serious developer and investor attention.Significant Risks (The Cautionary Tale):

Extreme Volatility: Low market cap and high speculation lead to wild price swings.Execution Risk: The technology is complex; failure to secure major partnerships or scale effectively could stall growth.Competition: Faces competition from other ZK projects and established scaling solutions.Token Unlock Risk: A large portion of the total supply (1.02 billion tokens) is not yet in circulation; future unlocks could depress price.Verdict: ZKC is a high-risk, high-potential-reward investment. It is suitable for investors with a higher risk tolerance who are betting on the long-term adoption of ZK-proof technology and believe Boundless can capture a meaningful share of that market. It is not suitable for conservative investors or those seeking stable returns.

How to Buy Boundless (ZKC) on WEEX ExchangeFor those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

Guide Step-by-Step Guide: Buying Boundless (ZKC) on WEEX ExchangeStep 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX address.Step 3: Execute Your PurchaseWEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Boundless (ZKC) and your fiat currency.Enter the amount and choose the payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for ZKC/USDT.Choose order type: Market Order or Limit OrderEnter amount and execute trade.Final Thoughts: Is Boundless (ZKC Coin) a Good Investment?Boundless Network is establishing itself as a pivotal innovation within the zero-knowledge infrastructure landscape. Its core architectural approach of integrating verifiable proof markets natively on the blockchain eliminates intermediary dependencies, substantially enhances network scalability, and achieves dramatically faster transaction finality for rollups and smart contract platforms.

The ZKC token serves as the fundamental economic conduit within this ecosystem. It orchestrates the alignment of incentives among proof providers, application developers, and end-users, ensuring the network operates as a cohesive and efficient marketplace.

With the accelerating mainstream integration of zero-knowledge technology, Boundless and its native ZKC token are strategically positioned to be integral components in enabling the next generation of scalable, secure, and interoperable blockchain systems.

Ready to be part of the evolution?

[Sign up now and trade Boundless (ZKC) on WEEX Exchange], where advanced tools meet a secure trading environment.

FAQ:Q1: What is the main purpose of the Boundless Network?A: Boundless provides a decentralized marketplace for zero-knowledge proofs, helping blockchains and rollups scale by verifying computations off-chain quickly and cheaply.

Q2: Does ZKC Coin have real utility, or is it just speculative?A: It has clear utility: it's used as payment for proof services and to incentivize network participants. However, its current market price is heavily influenced by speculation alongside this utility.

Q3: What is the biggest risk for ZKC investors in 2026?A: The primary risk is adoption failure. If the protocol doesn't attract significant usage from major blockchain projects, its utility value will not support the price, leading to potential decline amidst high volatility.

Q4: What is ZKC Coin used for?A: ZKC is used for prover incentives, payments within the network, and participation in Boundless’ economic model.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

When investors search “what is PENGUIN crypto” or “what is Nietzschean Penguin,” they encounter a defining example of a modern, purebred memecoin. Nietzschean Penguin (PENGUIN) is a cryptocurrency launched on the Solana blockchain that intentionally forgoes any claims of traditional utility, a development roadmap, or intrinsic technological value.

Its identity is constructed entirely around a viral internet narrative—blending philosophical nihilism with the relatable “Penguin Trend” meme symbolizing burnout and rebellion. This narrative serves as its sole value proposition, making PENGUIN a quintessential sentiment-driven asset. Its price is almost exclusively dictated by social media hype, community momentum, and speculative trading volume within the fast-paced Solana ecosystem. Understanding that PENGUIN trades on attention, not utility, is the first critical step for any potential buyer.

What Is Nietzschean Penguin (PENGUIN)?PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

This stands in direct contrast to cryptocurrencies with underlying utility. PENGUIN derives its market worth almost exclusively from narrative and collective sentiment. Its price is predominantly a function of social media traction, shifts in trader psychology, and the momentum of speculative trading flows, completely detached from traditional valuation metrics like user adoption, network activity, or fundamental protocol usage.

Origin of the Nihilist Penguin MemeThe viral video that sparked the trend began as an unexceptional piece of wildlife documentation. Its transformation was entirely human-made. As social media users recontextualized the scene by adding captions expressing existential anxiety and themes of voluntary isolation, the footage underwent a complete semantic shift. It was no longer a simple biological observation; it was elevated into a broader, culturally resonant philosophical symbol.

A pivotal moment in its spread was its adoption on social media platform X. Influential accounts, such as that of user @adi_thatipalli, were instrumental in recasting the penguin's solitary trek as a poignant meditation on absurdity, autonomy, and the search for purpose. From this point, platform algorithms efficiently propagated the newly framed narrative to a global audience, cementing its status as a digital-age parable.

Nietzschean Penguin (PENGUIN) Market Analysis: Volatility, Liquidity & Key RisksAs of late January 2026, PENGUIN’s market data paints a classic picture of a high-risk memecoin in a volatile phase:

Price: Approximately $0.12, subject to intraday swings exceeding 20-30%.Market Capitalization: Fluctuating around $120 million, indicating significant speculative interest.24-Hour Trading Volume: Frequently surpasses $150 million, often exceeding its own market cap—a hallmark of extreme speculative churn.Available Liquidity: Relatively thin at ~$1.6 million in decentralized pools.The Critical Risk: The Liquidity-Volume MismatchThis environment creates PENGUIN’s paramount risk: a massive discrepancy between high trading volume and shallow liquidity. This means that large sell orders (from so-called “whale” wallets) cannot be easily absorbed by the market, inevitably causing precipitous price drops. For retail traders, this translates to potential slippage (receiving a worse price than expected) and the risk of being unable to exit a position during a downturn without sustaining severe losses. It is a market structure designed for high volatility and requires sophisticated risk management.

PENGUIN Price Prediction 2026Forecasting PENGUIN requires abandoning traditional financial models. Its value is not tied to cash flow or adoption, but to the unpredictable ebb and flow of online sentiment. Below is a structured look at potential 2026 trajectories based on market psychology and historical memecoin cycles.

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

ScenarioPrice RangeProbabilityKey Catalysts & Market ConditionsTrader ImplicationsBearish$0.007 – $0.015HighMeme fatigue sets in; broader crypto bear market; concentrated holders take profits.Likely the terminal phase for most “hype-cycle” memecoins. Risk of near-total capital loss.Neutral / Consolidation$0.02 – $0.03MediumSpeculative interest stabilizes; token finds a temporary range amid rotating hype.Characterized by sharp, brief pumps and dumps within a band. Demands active trading.Bullish (Speculative Surge)$0.03 – $0.05+LowListing on a major Tier-1 exchange (e.g., Binance); new viral narrative or celebrity endorsement.Any surge would be explosive but short-lived, creating a narrow exit window for profitable trades.Analyst Perspective: It is crucial to view these not as investment growth projections, but as potential volatility corridors. The “Bullish Scenario” represents a temporary speculative spike, not sustainable appreciation. The “Bearish Scenario” remains a statistically probable outcome for assets without fundamental backing.

How to Buy Nietzschean Penguin (PENGUIN) CryptoFor those proceeding after evaluating the risks, knowing how to buy PENGUIN crypto safely is essential. The primary route is through WEEX Exchange.

Step-by-Step Guide: Buying PENGUIN on WEEX ExchangeStep 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX address.Step 3: Execute Your PurchaseWEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Penguin (PENGUIN) and your fiat currency.Enter the amount and choose the payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for PENGUIN/USDT.Choose order type: Market Order or Limit OrderEnter amount and execute trade.Is Nietzschean Penguin (PENGUIN) a Good Investment?Potential (But Fleeting) Upsides:Asymmetric Returns: During peak hype, price can multiply rapidly in a short timeframe.Community Momentum: Strong, engaged communities can temporarily propel prices.Solana Memecoin Cycle: Benefits from being on the blockchain currently dominant for retail meme trading.Severe and Fundamental Risks:Zero Underlying Value: No product, service, revenue, or cash flow. The token is a digital token of sentiment.Extreme Volatility: Designed for high volatility, which can wipe out portfolios just as fast as it builds them.Concentration Risk (“Whales”): A small group of early holders often owns a large supply, giving them disproportionate power to move the market.Regulatory Target: Pure memecoins are increasingly under scrutiny by global regulators as potential unregistered securities or vehicles for market manipulation.Investment Verdict: Nietzschean Penguin (PENGUIN) does not qualify as a traditional “investment.” It is a high-stakes speculative instrument. It may be suitable only for a very small, risk-designated portion of a portfolio for traders with strict discipline, active management strategies, and the emotional fortitude to withstand total loss. It is emphatically not suitable for long-term “HODLing,” retirement savings, or risk-averse individuals.

Final Thoughts on Nietzschean Penguin (PENGUIN)The Nietzschean Penguin (PENGUIN) token serves as a perfect case study in the power and peril of narrative-driven crypto assets. While detailed PENGUIN price prediction models outline potential paths, they ultimately underscore that this is a game of musical chairs dictated by sentiment, not value.

For the disciplined trader, it represents a volatile instrument for short-term speculation. For the market observer, it is a fascinating lens into internet culture and behavioral finance. For everyone, it is a potent reminder that in the absence of fundamentals, extreme caution is the only prudent strategy.

Ready to trade with a platform that provides tools for volatile markets?

[Sign up now and Explore Nietzschean Penguin (PENGUIN) on WEEX], where you can access advanced trading features designed for managing high-risk environments.

Further ReadingWhat Is USOR? Can I Invest in USOR?Which Crypto Will Go 1000x in 2026?Is JGGL (JGGL) a Good Investment? JGGL (JGGL) Price PredictionDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For those searching "What Is Sentient (SENT)", it represents a paradigm shift in artificial intelligence development. Sentient (SENT) is an open-source, decentralized platform with the ambitious goal of building Artificial General Intelligence (AGI). In contrast to the closed, proprietary models dominated by corporations like OpenAI and Google, Sentient operates on a foundational belief: the future of transformative AI should be transparent, accountable, and governed by a global community rather than a single entity.

The project positions itself not merely as an alternative, but as a necessary evolution to mitigate the centralization risks inherent in current AI development. By leveraging blockchain technology, Sentient aims to create a "community-owned" intelligence network where contributions, governance, and benefits are shared among its participants.

How Sentient (SENT) WorksUnderstanding "how Sentient (SENT) works" is key to grasping its innovation. The core of its architecture is the Sentient GRID, a revolutionary coordination framework.

The Sentient GRID: A Unified Neural NetworkThink of the GRID as the decentralized "brain" and "nervous system" of the platform. It doesn't host AI models centrally but acts as an intelligent orchestrator that connects:

Distributed Computing Power: Hardware from contributors worldwide.Diverse AI Models & Algorithms: Specialized models contributed by developers.Varied Data Sources: Curated and validated data sets.This allows fragmented resources to function as a cohesive, powerful AGI entity, enabling smaller developers to collectively compete with tech giants.

A Decentralized Incentive ModelThe system is driven by a participatory incentive model. Contributors who provide valuable resources—such as high-quality data, computational power, or model improvements—are rewarded with SENT tokens. This creates a self-sustaining ecosystem where contribution directly fuels network growth and value.

Transparent & Verifiable DevelopmentAll operations on the GRID, from data usage to model training steps, can be audited on the blockchain. This ensures the transparency and accountability that closed-source systems lack, addressing critical ethical and safety concerns in AGI development.

Origin of Sentient (SENT)The "origin of Sentient (SENT)" is rooted in a response to AI centralization and is backed by significant conviction from the venture capital world. The project was founded to materialize the vision of open, democratic AGI.

Its credibility is underscored by formidable financial backing. Sentient has secured funding in multiple rounds from a consortium of top-tier investors, including Framework Ventures, Pantera Capital, Founders Fund, and HashKey Capital. This level of institutional support signals strong belief in the project's technical viability and its foundational thesis within both the crypto and AI industries.

Sentient (SENT) Tokenomics: The SENT Token UtilityThe "Sentient (SENT) tokenmics" are designed to be the lifeblood of the ecosystem, with the SENT token serving multiple critical functions:

Network Incentives: The primary use is to reward contributors (data providers, compute providers, developers) for the resources they bring to the Sentient GRID.Governance: SENT token holders will likely have the right to participate in key decisions regarding the platform's development, protocol upgrades, and resource allocation, embodying the community-owned principle.Network Access & Fees: SENT may be used to pay for services within the ecosystem, such as accessing specialized AI models or purchasing computational power on the GRID.How to Buy Sentient (SENT) on WEEX Exchange: A Step-by-Step GuideFor investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

Step-by-Step Guide: Buying Sentient (SENT) on WEEX ExchangeStep 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX address.Step 3: Execute Your PurchaseWEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Sentient (SENT) and your fiat currency.Enter the amount and choose the payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for SENT/USDT.Choose order type: Market Order or Limit OrderEnter amount and execute trade.H3: Why Choose WEEX to Buy SENT?Security & Compliance: A regulated platform offering a safe trading environment.Competitive Liquidity: Ensures you can execute trades at fair prices with minimal slippage.User-Friendly Interface: Suitable for both novice and experienced traders navigating the crypto-AI niche.H2: Conclusion: Sentient's Role in the Future of AISentient (SENT) is more than a cryptocurrency; it is a bold infrastructural bet on a decentralized future for artificial intelligence. By tackling the critical issues of transparency and centralization through its Sentient GRID and community-driven model, it presents a compelling alternative to the status quo.

While building AGI is a monumental challenge, Sentient's open-source approach, strong backing, and well-designed tokenomics position it as a pioneering project at the intersection of blockchain and AI. For investors and believers in democratized technology, it represents a unique opportunity to participate in this foundational shift.

Ready to be part of the decentralized AI evolution?

[Sign up now and trade Sentient (SENT) on WEEX Exchange], where advanced tools meet a secure trading environment.

Further ReadingFutures Trading in Crypto: A Beginner’s Guide in 2026Which Crypto Will Go 1000x in 2026?What Is zkPass (ZKP)? The Complete Guide to the Privacy-Powered Data Verification ProtocolDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What Is Ripple USD (RLUSD)? Is Ripple USD (RLUSD) a Good Investment?

For investors and institutions searching "what is Ripple USD (RLUSD)", the answer marks a significant evolution in blockchain-based finance. Ripple USD (RLUSD) is a fully regulated, 1:1 U.S. dollar-backed stablecoin issued by Ripple Labs' subsidiary, Standard Custody & Trust Company, LLC.

Unlike many stablecoins built primarily for retail DeFi, RLUSD was engineered from the ground up for enterprise and institutional use, focusing on cross-border payments and global settlement. Its launch represents Ripple's strategic move to provide a compliant, stable digital dollar that complements its native XRP asset, creating a comprehensive toolkit for value transfer on the blockchain.

Why RLUSD Stands OutUnderstanding what sets RLUSD apart is crucial when evaluating stablecoin options. Its design prioritizes regulatory compliance, transparency, and institutional-grade security.

Unmatched Regulatory ComplianceRLUSD's foremost differentiator is its regulatory foundation. It is issued under a New York Department of Financial Services (NYDFS) Trust Company Charter. New York's regulatory framework is among the world's most stringent, ensuring RLUSD adheres to the highest standards of consumer protection, anti-money laundering (AML), and capital reserve requirements.

Fully-Backed, Segregated ReservesTrust is paramount. RLUSD is 100% backed by a segregated reserve consisting of:

U.S. dollar cash deposits in accredited banks.Short-term U.S. government treasury bills.Other high-quality cash equivalents. These reserves are held separately from Ripple's corporate funds and are subject to monthly third-party attestation reports, providing unparalleled transparency.Native Multi-Chain Issuance for Maximum UtilityTo drive adoption and liquidity, RLUSD is natively issued on two leading blockchains:

XRP Ledger (XRPL): Leverages its speed (3-5 second settlement) and low cost for efficient payments.Ethereum: Provides immediate access to the vast Decentralized Finance (DeFi) ecosystem, including lending protocols, DEXs, and yield farms. This dual-chain strategy ensures RLUSD is both a powerful payment tool and a versatile DeFi asset.How Does Ripple USD (RLUSD) WorkRLUSD is not just a digital dollar; it's a foundational financial primitive designed for specific, high-value applications:

Enterprise Cross-Border Payments: Enables corporations and financial institutions to settle international transactions in real-time, 24/7, bypassing the slow and costly traditional correspondent banking network (SWIFT).DeFi and On-Chain Finance: Serves as a primary stable asset for trading pairs, collateral in lending protocols, and the settlement layer for tokenized real-world assets (RWAs) like bonds or commodities.Reliable On/Off Ramp: Functions as a stable and compliant bridge for users and institutions to move fiat currency onto and off of blockchain networks with confidence.Is Ripple USD (RLUSD) a Good Investment?While Is Ripple USD (RLUSD) a Good Investment? is designed as a low-risk stablecoin, prudent investors should be aware of the landscape:

Regulatory Evolution: As a centrally issued asset, RLUSD is subject to the evolving regulatory stance towards stablecoins, particularly in the U.S. and EU.Counterparty Risk: Trust is placed in Ripple and its appointed custodians to maintain full, segregated reserves. The monthly attestations are critical for ongoing verification.Competitive Market: RLUSD enters a market dominated by giants like USDT and USDC. Its success hinges on adoption within Ripple's existing enterprise network and the broader DeFi space.Conclusion: The Strategic Role of RLUSDRipple USD (RLUSD) is more than just another stablecoin. It is a strategically launched asset designed to bring the speed and efficiency of blockchain to institutional finance while operating within a clear regulatory perimeter. For enterprises, it offers a compliant tool for global payments. For investors and DeFi users, it provides a new, transparently backed stable asset option.

Its long-term success will depend on adoption within Ripple's existing banking partnerships and its ability to capture market share in the competitive DeFi ecosystem. For those seeking a stablecoin with a strong regulatory pedigree, RLUSD represents a compelling option.

For a secure platform to trade leading assets like Bitcoin and explore regulated options, consider WEEX Exchange. It offers a secure environment with deep liquidity and competitive fees, ideal for building a modern portfolio.

[Sign up on WEEX today] to start trading now!

Further ReadingWhat is Memes Will Continue (MEMES): A Complete GuideWhich Crypto Will Go 1000x in 2026?Is JGGL (JGGL) a Good Investment? JGGL (JGGL) Price PredictionDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Trump Family Crypto Project Exlpained: How Much Has the Trump Family Earned from Crypto?

The intersection of high-profile politics and cryptocurrency has reached a new peak with the Trump family crypto project. Officially operating under the name World Liberty Financial, this venture has become one of the most scrutinized and financially significant phenomena in the digital asset space. Launched in 2024, it positions itself as a blockchain-based financial platform with ambitions in decentralized finance (DeFi) and peer-to-peer lending.

At its core are two primary assets:

WLFI Token: The platform's governance token.TRUMP Meme Coin: A collectible asset leveraging the Trump brand.This project raises fundamental questions about the fusion of political influence, celebrity, and blockchain technology, making it essential for investors to look beyond the hype.

Who Really Owns and Controls World Liberty Financial?When searching "who owns World Liberty Financial," the answer reveals a structure designed to centralize benefits. Public disclosures show that Donald Trump Jr., Eric Trump, and Barron Trump are listed as co-founders.

Read More: What Is World Liberty Financial (WLFI) and How Does It Work?

The Revenue Model: A Direct Line to the Trump OrganizationThe most critical aspect of ownership is the revenue flow. A Trump Organization entity is contractually entitled to 75% of all revenue generated from primary WLFI token sales. This means the majority of funds raised from investors go directly to the family's business holdings, not necessarily back into platform development.

Key Investors and InfluenceBeyond the family, ownership extends to major investors who acquired large portions of the token supply:

Justin Sun: The Tron founder reportedly invested up to $75 million, with over $50 million of that flowing to Trump entities per the revenue share.Other Institutional Investors: The project attracted significant capital from foreign institutions, concentrating token ownership and raising questions about political lobbying and regulatory influence.WLFI Token Analysis: Performance, Utility, and ControversyWLFI Token Price and VolatilityThe World Liberty Financial (WLFI) token exemplifies extreme speculative volatility. After launching around $0.31 in September 2025, it briefly surged before collapsing nearly 65%, trading around $0.14 by early 2026. This price action highlights the high risk for secondary market traders, especially as founders secured profits upfront during the initial sales phase.

The Governance Utility QuestionA major point of criticism is the token's limited real-world utility. Unlike typical DeFi governance tokens, WLFI offers minimal voting rights and no direct profit-sharing mechanism for holders. Its value is largely derived from speculative trading and its association with the Trump brand rather than fundamental platform usage or revenue.

The Justin Sun Connection: Investment and ScrutinyJustin Sun's deep involvement is a focal point for controversy. His substantial investment coincided with a reported pause in U.S. regulatory investigations into his other businesses. This sequence of events has intensified debates about "pay-to-play" dynamics and whether the project functions as a conduit for political influence, blurring the lines between finance, crypto, and policymaking.

How Much Has the Trump Family Earned from CryptoThe financial scale of this venture is staggering. Analysis indicates the Trump family earned over $800 million from crypto in the first half of 2025 alone.

~$463 million from WLFI primary token sales.~$300+ million from the TRUMP meme coin.Furthermore, the family retains a large "paper" portfolio of WLFI tokens, meme coins, and related equities estimated at over $11 billion, tying their financial future closely to the crypto market's performance.

Trump’s Crypto Strategy ExplainedThe project cannot be viewed in isolation; it's a cornerstone of a broader strategic shift. Donald Trump's public stance on crypto evolved from criticism in 2021 to full-throated endorsement by 2024. This aligned with tangible policy actions:

Regulatory Pullback: Easing enforcement and banking restrictions for crypto firms.Promotion of Family Ventures: Using political capital to promote World Liberty Financial.This strategy suggests an effort to cultivate the crypto sector as a political and financial base, with family-branded projects positioned to benefit disproportionately from a favorable regulatory environment.

Conclusion: Can I Invest in HTrump Family Crypto Project?The Trump family crypto project stands as a landmark case study in 2026. World Liberty Financial and the WLFI token demonstrate how celebrity, political power, and blockchain can converge to generate immense wealth, but also invite intense ethical and financial scrutiny.

For the market, it represents a high-risk, speculation-driven asset whose value is heavily tied to political fortunes and regulatory decisions rather than traditional tech or financial metrics. Investors must weigh the unique brand-driven momentum against the profound risks of volatility, concentrated ownership, and political controversy.

For traders navigating politically-linked tokens like World Liberty Financial (WLFI), WEEX Exchange offers a secure, professional platform to trade with clarity. Access a wide range of assets and manage volatility with advanced tools.

Sign up on WEEX today to start trading now!

Further ReadingWhat is Memes Will Continue (MEMES): A Complete GuideWhich Crypto Will Go 1000x in 2026?Is JGGL (JGGL) a Good Investment? JGGL (JGGL) Price PredictionDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Space Coin Explained: In-Depth Analysis & How to Buy on WEEX in 2026

When investors search "what is space coin", they are looking for clarity on a project that sits at the cutting edge of Web3 infrastructure. Space Coin (SPACE) is not just another cryptocurrency; it is a decentralized physical infrastructure network (DePIN) project that aims to build a global, blockchain-coordinated satellite internet constellation.

Its core mission is to provide permissionless, resilient internet access, particularly in underserved regions, by merging Low Earth Orbit (LEO) satellite technology with decentralized blockchain governance and payments. This addresses two critical modern challenges: digital inclusion and infrastructure resilience.

What is SPACE (SPACE) Coin?Spacecoin is pioneering a new era in the space economy by making it more accessible and participatory. As the inaugural decentralized physical infrastructure network (DePIN) utilizing a proprietary constellation of low-Earth orbit (LEO) satellites, Spacecoin leverages blockchain-integrated nanosatellites to deliver global, decentralized, and permissionless internet connectivity. Having successfully deployed its initial satellites into orbit, Spacecoin is actively working to connect remote and underserved populations, laying the groundwork for a more inclusive and equitable digital world.

Why Space Coin Stands OutIn a crowded crypto market, Space Coin’s value proposition is uniquely tangible. Here’s what sets it apart:

Physical Infrastructure Backing: Unlike purely digital assets, SPACE is backed by the ongoing deployment of real satellites (e.g., CTC-0 launched in 2024). This provides a measurable, real-world utility foundation.DePIN Model: It operates on the "DePIN" thesis, where the token incentivizes the build-out and maintenance of a global physical network—a model gaining significant traction for its real-world impact.Proven Leadership & Strategic Advisors: The team, led by founder Tae Oh (Gluwa, Creditcoin) and operational head Stuart Gardner, brings relevant blockchain and aerospace experience. Advisors like General Wesley Clark (security) and Youngky Kim (ex-Samsung, telecom) add crucial strategic depth for a project of this scale and regulatory complexity.Clear, Phased Roadmap: The project communicates a long-term, infrastructure-focused timeline, managing expectations and demonstrating a commitment to execution over hype.Space Coin Analysis 2026: Prospects, Catalysts & RisksA balanced Space Coin analysis must weigh its ambitious vision against execution risks. Here’s a breakdown of key factors influencing its trajectory in 2026:

Growth Catalysts & Bullish Factors:DePIN Sector Momentum: As a leading DePIN project, SPACE benefits from growing investor capital and narrative focus on token-incentivized real-world infrastructure.Milestone Achievement: Successful launch and testing of subsequent satellite constellations (beyond CTC-0/1) would be a major proof-of-progress, likely positively impacting token valuation.Strategic Partnership Announcements: Partnerships with telecom operators, governments, or other blockchain ecosystems for pilot programs could validate the technology and business model.Regulatory Tailwinds: Clearer global regulations supporting satellite internet and blockchain integration could reduce a significant operational uncertainty.Key Risks & Challenges:Extreme Capital Intensity & Execution Risk: Building and launching satellites is astronomically expensive and technically fraught. Delays or launch failures are inherent risks.Regulatory Hurdles: Operating a global satellite network requires navigating a complex web of international telecommunications and space regulations.Fierce Competition: It competes with well-funded giants (e.g., Starlink, Amazon's Project Kuiper) and other blockchain-based initiatives, making market capture challenging.Long Time Horizon & Adoption Risk: The path to profitability is long. Token value in the near-to-mid term may be driven more by speculation than realized network usage and revenue.Verdict: Space Coin represents a high-risk, high-potential-reward investment in a foundational Web3 thesis. It is suited for investors with a long-term horizon and a high risk tolerance, who believe in the DePIN model and are comfortable with the project's multi-year development timeline.

How to Buy Space Coin on WEEX Exchange?For those convinced by the analysis and searching "how to buy space coin on weex" or "buy space coin on weex exchange", the process is straightforward. WEEX provides a secure and user-friendly platform to acquire SPACE tokens.

Why Choose WEEX to Buy SPACE?Security: Implements institutional-grade security protocols, including cold storage for funds and mandatory 2FA.Competitive Fees: Offers some of the lowest trading fees in the industry, maximizing your investment.Intuitive Interface: Designed for both beginners and pros, making your first purchase simple.Reliable Liquidity: Ensures you can execute trades at fair market prices with minimal slippage.Step-by-Step Purchase Guide:Step 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX wallet address.Step 3: Execute Your PurchaseWEEX offers three primary methods to buy cryptos:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Space Coin (SPACE) and your fiat currency.Enter the amount and choose the payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for SPACE/USDT.Choose order type: Market Order or Limit Order.Enter amount and execute trade.Conclusion: A Strategic Look at Space CoinSpace Coin (SPACE) is a pioneering project attempting to solve a massive real-world problem through blockchain innovation. Our Space Coin analysis concludes that it is a speculative, long-term infrastructure bet with a credible team and a clear, albeit challenging, mission.

For investors who have conducted their own research (DYOR) and align with its vision, buying SPACE on a secure, regulated platform like WEEX Exchange is a prudent way to gain exposure. Remember to only invest what you can afford to lose, given the project's inherent risks and long development cycle.

Ready to explore the Space Coin(SPACE) opportunity?

[Sign up on WEEX today] to access a secure trading environment and begin your journey.

Further ReadingWhat is Memes Will Continue (MEMES): A Complete GuideWhich Crypto Will Go 1000x in 2026?Is JGGL (JGGL) a Good Investment? JGGL (JGGL) Price PredictionDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

WEEX Staking: Secure On-Platform Staking for Long-Term Crypto Growth

As the crypto market continues to evolve, users are increasingly looking beyond short-term trading toward more sustainable ways to grow their assets. To meet this shift in user demand and further enhance its product ecosystem, WEEX continues to expand its one-stop crypto platform with solutions that go beyond trading. WEEX Staking is one of these key additions, enabling users to earn ongoing rewards on their assets within a secure and seamless on-platform experience.

What Is WEEX StakingWEEX Staking is a platform-level staking product launched by WEEX, allowing users to stake major cryptocurrencies directly within the exchange to earn ongoing rewards. By keeping the entire process on-platform, WEEX Staking enables users to generate yield while maintaining exposure to their assets’ market value.

Unlike on-chain staking, WEEX Staking requires no complex blockchain operations, external wallets, or private key management. It is designed for long-term holders seeking a simple, secure, and steady asset growth solution, offering a more efficient alternative to frequent crypto trading.

Why WEEX Staking Matters TodayIn today’s market environment, reliance on high-frequency trading alone has become increasingly challenging. Even users who focus on trade-to-earn or AI trading strategies are recognizing the importance of balancing active trading with more stable, long-term yield mechanisms.

Staking has emerged as a widely adopted approach to asset management, especially during volatile or sideways markets. WEEX Staking allows users to continue earning returns even when trading opportunities are limited, offering a more resilient and diversified way to grow assets across different market cycles.

Inside the WEEX Staking ProductWEEX Staking currently supports BTC, ETH, SOL, and USDD, enabling users to earn rewards on major digital assets directly within the WEEX exchange. Compared with similar staking products on other platforms, WEEX stands out with a fully on-platform process — no external transfers, no third-party protocols, and no complex steps. Subscriptions, holding, and reward distribution are all completed seamlessly inside WEEX, offering higher transparency, better asset security, and a smoother user experience, especially for users who value simplicity and capital efficiency.

As a credible exchange with 1,000 BTC reserved specifically for user protection, WEEX adds an extra layer of security beyond technical safeguards. Combined with WEEX’s centralized custody, platform-level risk controls, and audited operational processes, staking on WEEX avoids common on-chain exposures such as smart contract vulnerabilities or private key mismanagement, allowing users to participate with greater confidence and peace of mind.

How WEEX Staking Benefits WEEX UsersFor WEEX users, WEEX Staking delivers a true one-stop experience for trading, holding, and earning. Users can participate in staking without navigating complex deposits and withdrawals or managing multiple accounts across platforms.

By filling the gap between active trading and long-term holding, WEEX Staking strengthens WEEX’s vision of a unified crypto platform. Whether users focus on trade to earn strategies, AI trading, or long-term asset allocation, WEEX Staking provides an efficient and secure way to enhance overall portfolio performance within a single trusted environment.

About WEEXFounded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 150 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200 spot trading pairs and offering up to 400x leverage in crypto futures trading. In addition to the traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Is Coinbase Global Inc. (COIN) a Good Investment? Price Predictions, Analysis & Trading Guide

As an established player in the crypto ecosystem, Coinbase Global Inc. (COIN) represents more than just a stock—it’s a barometer for the digital asset industry’s health. Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase has evolved from a simple exchange into a multifaceted financial platform offering trading, custody, staking, and stablecoin services. Now listed on Nasdaq, COIN has become a key gateway for institutional and retail investors entering the crypto market. With renewed momentum in Bitcoin and broader adoption in 2026, many are asking: Is COIN a smart investment? In this article, we’ll break down COIN’s background, price history, influencing factors, and future forecasts—and show you how to trade it on platforms like WEEX.

What Is Coinbase Global Inc. (COIN)?Unlike typical cryptocurrencies, COIN is a publicly traded equity (ticker: COIN) that represents ownership in Coinbase, one of the world's largest and most regulated cryptocurrency exchanges. It does not function as a native blockchain token but operates as a stock, making it a unique hybrid asset in the crypto space.

Key Features of Coinbase Global Inc. (COIN):Regulatory Compliance: Known for its adherence to U.S. regulations, attracting institutional trust.Diverse Ecosystem: Offers spot trading, derivatives, staking, wallet services, and USDC stablecoin integration.Market Proxy: Often moves in correlation with Bitcoin and overall crypto sentiment.Strong Institutional Backing: Approximately 70% of shares are held by institutions, indicating long-term confidence.Current Market Status (as of January 2026):Price: ~$250Market Cap Rank: #111 (via CoinMarketCap)Monthly Gain: +15%Yearly Performance: +35% from early 2025 lowsCOIN Price History & Current TrendsCOIN’s journey has mirrored the volatility of the crypto market:

2021: Peaked above $400 post-IPO during Bitcoin’s bull run.2022: Fell below $50 amid the crypto winter.2024–2025: Recovered 40–50% due to regulatory progress and product expansion.2026: Trading around $250 with positive momentum, supported by Bitcoin’s rally and growing institutional participation.The Fear & Greed Index currently sits at 65 (Greed), reflecting optimistic market sentiment.

Key Factors Influencing COIN’s Future Price1. Crypto Market CyclesCOIN’s performance is closely tied to Bitcoin and Ethereum trends. Bull runs typically drive trading volume and fee revenue higher.

2. Institutional AdoptionGrowing custody services, BlackRock’s involvement, and expansion into derivatives (e.g., Deribit acquisition) could significantly boost revenue.

3. Regulatory DevelopmentsPositive legislation around stablecoins and digital assets may reduce uncertainty and attract more institutional capital.

4. Revenue DiversificationExpansion into payments, Web3 services, and international markets could reduce reliance on trading fees.

5. Macroeconomic ConditionsInflationary periods often benefit crypto-related equities, while recessions and rate hikes may pressure valuations.

Technical Analysis & Price PredictionsWeekly Forecast (January–February 2026)td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

WeekMin PriceAvg PriceMax PriceJan 15–21$248$255$262Jan 22–28$250$258$265Jan 29–Feb 4$255$262$270Long-Term Price Forecast (2026–2030)td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

YearMin PriceAvg PriceMax Price2026$240$280$3202027$300$350$4002028$350$400$4502029$400$450$5002030$450$500$550Can i Invest in Coinbase Global Inc. (COIN)?Investing in COIN offers exposure to the growing cryptocurrency ecosystem through a regulated, publicly traded entity. However, it requires a risk-aware approach and an understanding of its dual nature—as both a technology stock and a proxy for crypto market sentiment.

Prospective investors are encouraged to:

Monitor regulatory developments closely.Assess personal risk tolerance given COIN’s volatility.Diversify holdings to mitigate sector-specific risks.Stay informed about Coinbase’s quarterly performance and strategic initiatives.If you are comfortable with these dynamics and have a medium- to long-term perspective, COIN may represent a strategic addition to a diversified portfolio—especially for those bullish on the future of digital assets and institutional crypto adoption.

Why Trade COIN on WEEX?For traders looking to gain exposure to Coinbase’s growth without buying the stock directly, WEEX offers COIN/USDT perpetual contracts with leverage, tight spreads, and deep liquidity. Here’s why WEEX stands out:

Advantages of Trading COIN on WEEX:Leveraged Exposure: Trade with up to 20× leverage to amplify potential returns.24/7 Trading: Unlike traditional stock markets, trade COIN contracts anytime.Risk Management Tools: Use stop-loss, take-profit, and trailing stop features.User-Friendly Interface: Designed for both beginners and advanced traders.Strong Security: Compliant platform with institutional-grade protection.How to Get Started to Trade COIN/USDT Perpetual Contracts:Sign up on WEEX and complete verification.Deposit USDT or other supported cryptocurrencies.Navigate to Futures and search for "COIN/USDT."Choose leverage, set your position size, and execute your trade.Conclusion: Is COIN a Good Investment?COIN represents a strategic bet on the future of cryptocurrency adoption. With its established regulatory standing, diversified revenue streams, and institutional backing, it is well-positioned to benefit from the next wave of crypto growth. However, investors should remain cautious of its volatility and regulatory risks.

For traders, COIN/USDT perpetual contracts on WEEX offer a flexible way to speculate on its price movements with leverage, whether you’re bullish or bearish in the short term.

As always, conduct your own research, diversify your portfolio, and never invest more than you can afford to lose.

Further ReadingWhat is MSTR Stock? Where to Trade MSTR/USDT Perpetual Futures?NVDA Stock Analysis: Why Trade NVDAUSDT Perpetual Futures on WEEX?What is AAPL stock? AAPL/USDT Perpetual Futures ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

How to Buy Bitcoin on WEEX Exchange: Your Ultimate Guide to Purchasing Bitcoin

If you're searching for "how to buy bitcoin", "where to buy bitcoin", or specifically "buy bitcoin on WEEX exchange", you’ve found the definitive resource. As cryptocurrency adoption accelerates, choosing a reliable platform is crucial. WEEX Exchange stands out as a secure, user-friendly, and globally accessible platform trusted by both beginners and experienced traders. This comprehensive guide will walk you through every step of purchasing Bitcoin on WEEX, while also exploring advanced features for those looking to trade bitcoin or trade bitcoin on WEEX with greater sophistication.

What Is Bitcoin?Before executing your first purchase, it’s essential to understand what Bitcoin is. Created in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin (BTC) is the world’s first decentralized digital currency. It operates on a peer-to-peer blockchain network, eliminating the need for central authorities like banks or governments. Often called “digital gold,” Bitcoin has evolved from an experimental technology into a globally recognized store of value and medium of exchange. Its limited supply of 21 million coins, transparent ledger, and growing institutional adoption make it a foundational asset in any cryptocurrency portfolio.

Learn More: What Is Bitcoin? A Simple Guide for Crypto Beginners

Is WEEX Exchange Good? Evaluating a Top Bitcoin Trading PlatformWhen researching where to buy bitcoin, security, fees, and usability are paramount. Here’s why WEEX consistently ranks among the best platforms to trade bitcoin:

Security & TrustRegulatory Compliance: Licensed and operating under strict financial regulations.Cold Storage: Majority of user funds held in offline, multi-signature wallets.Two-Factor Authentication (2FA): Required for withdrawals and sensitive actions.Insurance Fund: Additional protection for user assets.User Experience & AccessibilityIntuitive Interface: Streamlined for beginners, with advanced tools for pros.Multiple Payment Methods: Bank transfer, credit/debit card, Apple Pay, Google Pay, and local payment options.Global Support: Available in 150+ countries with multi-language customer service.Mobile App: Fully-featured iOS and Android apps for trading on the go.Competitive AdvantagesLow Fees: Among the lowest trading fees in the industry.High Liquidity: Deep order books for minimal slippage.Fast Execution: Sub-second trade processing.How to Buy Bitcoin on WEEX: Step-by-Step GuideStep 1: Create and Verify Your WEEX AccountVisit the official WEEX website or download the mobile app.Click “Sign Up” and register using your email or phone number.Verify your email through the confirmation link.Complete KYC verification to unlock higher limits and enhanced security.Step 2: Deposit FundsNavigate to “Assets” → “Deposit” and select your preferred method:

Fiat Deposit: Use bank transfer, card payment, or supported third-party providers.Crypto Deposit: Send BTC, USDT, or other supported cryptocurrencies to your WEEX wallet address.Step 3: Execute Your Bitcoin PurchaseWEEX offers three primary methods to buy Bitcoin:

Method 1: Instant Buy (Recommended for Beginners)Go to “Buy Crypto” → “Quick Buy”.Select Bitcoin (BTC) and your fiat currency.Enter amount and choose payment method.Review and confirm. Bitcoin will be delivered to your spot wallet instantly.Method 2: Spot Trading (For Advanced Control)Navigate to “Trade” → “Spot”.Search for BTC/USDT.Choose order type:Market Order: Buy immediately at current price.Limit Order: Set your target price.Enter amount and execute trade.You can also check our tutorial video to learn how to buy bitcoin on WEEX Exchange. Check below:

Step 4: Secure Your BitcoinStore on WEEX: Convenient for active trading, protected by platform security.Withdraw to Private Wallet: For long-term storage, use a hardware wallet like Ledger or Trezor.Earn Interest: Explore WEEX Earn to stake your BTC for passive income.How to Trade Bitcoin on WEEX: Beyond Basic PurchasesFor users searching “trade bitcoin” or “trade bitcoin on WEEX”, the platform offers professional-grade tools:

Spot Trading: 200+ BTC trading pairs with advanced charting (TradingView integration).Futures Trading: Trade BTC perpetual contracts with up to 20x leverage.Copy Trading: Automatically replicate strategies of top-performing traders.Grid Trading: Set automated buy-low, sell-high strategies in volatile markets.Bitcoin Trading Tips for BeginnersStart Small: Begin with a comfortable amount as you learn.Use Stop-Loss Orders: Essential for risk management.Diversify: Don’t allocate everything to Bitcoin.Stay Updated: Follow crypto news and market analysis.Secure Your Account: Always enable 2FA and use strong passwords.Conclusion: WEEX is the Best Choice for Bitcoin TradingWhether you’re searching “how to buy bitcoin” as a first-time investor or looking to “trade bitcoin on WEEX” as an experienced trader, WEEX provides a secure, low-cost, and feature-rich environment. With multiple purchase options, advanced trading tools, and robust security measures, WEEX stands out as a premier platform for Bitcoin acquisition and trading.

Ready to start? Sign up on WEEX today and buy Bitcoin in under 5 minutes.

Further ReadingIf You Invested $1,000 in Bitcoin 10 years ago, Here’s How Much You’d Have NowHow to Trade Bitcoin Futures on WEEX?Bitcoin Volatility: Unraveling the Options-Driven Price DynamicsWhere to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

MEMES Coin Price Prediction 2026: Can This Meme Token Survive the Hype Cycle?

As the meme coin market matures in 2025–2026, sustainability is no longer just about viral moments—it's about attention retention, liquidity depth, and the ability to outlast initial speculation. One token that embodies this shift is MEMES Coin, a BNB Chain-based asset that’s showing signs of moving beyond the typical “pump-and-dump” pattern.

In this analysis, we examine MEMES Coin’s current market behavior, technical structure, and realistic price outlook for 2026—giving traders and observers a clear view of what to expect in the evolving meme economy.

Current Market Overview: Not Just Another Meme PumpUnlike many meme tokens that spike and collapse within days, MEMES Coin has displayed a more structured price movement:

Early impulsive rally followed by a controlled retracementVolume spikes aligned with volatility, not random noisePost-peak compression phase rather than a vertical collapseThis suggests MEMES is in what traders call an “attention digestion” phase—where early speculative interest has cooled, but the asset hasn’t been abandoned. For meme coins, this phase often separates those that fade from those that cycle back into relevance.

On-chain data indicates active participation, with higher-low defense behavior and volume-price correlation pointing to retained conviction—even amid cooling hype.

Read More: What is Memes Will Continue (MEMES): A Complete Guide

MEMES Coin Price Prediction 2026: Two ScenariosBullish Scenario: Attention Retention & Cyclical RecoveryConsistent liquidity across meme trading hubsRepeat visibility (not one-off virality)No major dilution or unlock shocksThen price could see stair-step appreciation in sync with broader meme coin rotations. Social reactivation, derivatives exposure, and rotational capital inflows could reignite price discovery.

Potential 2026 Price Range in Bull Scenario:

Q1–Q2 2026: $0.00012 – $0.00018H2 2026: $0.00020 – $0.00030 (if meme market rallies)Bearish Scenario: Attention Decay & Range-Bound TradingVolume declines steadilyCommunity engagement fragmentsNarrative relevance weakensThen MEMES could enter low-liquidity consolidation, with price moving inefficiently in a tight range. This would mean stagnation rather than crash—a gradual fade from relevance.

Expected Range in Bear Scenario:

2026 Average: $0.00005 – $0.00010Risk of lower support test: $0.00003Technical Outlook: Structure Over HypeRecent chart analysis highlights:

Volatility compression after impulse → signals market indecision, not exhaustion.Volume-price correlation → indicates real speculative interest.Higher-low defense → suggests retained holder conviction.MEMES does not exhibit classic blow-off top patterns. Instead, it behaves like a mid-cycle asset testing whether it can remain relevant beyond its first hype wave.

Key Factors Influencing MEMES Price in 2026Social MomentumThe token’s visibility on major platforms such as X (formerly Twitter) and TikTok remains its primary growth engine. Renewed viral attention or coordinated community campaigns can trigger sharp price rallies, typically in the range of 20–50% within short periods. Sustained social engagement is crucial for maintaining relevance.

BNB Chain Activity and PerformanceAs a token native to the BNB Smart Chain, MEMES is directly affected by the network's health and user experience. Periods of high transaction fees or network congestion can deter small-scale traders and reduce trading frequency, potentially suppressing volume and price momentum.

Meme Market Capital RotationMeme capital is highly fluid and tends to rotate among major tokens like Dogecoin (DOGE), Pepe (PEPE), Bonk (BONK), and dogwifhat (WIF). Significant capital inflows into or out of these leading memes will directly impact MEMES’s liquidity and speculative interest. Being part of a positive rotation can lead to outsized gains.

Centralized Exchange (CEX) ListingsCurrently traded mainly on decentralized exchanges (DEXs), a future listing on a Tier-1 centralized exchange like Binance, Coinbase, or Kraken would be a major catalyst. Such a listing would dramatically improve accessibility, attract a wave of new investors, and significantly boost trading volume and liquidity.

Broader Crypto Market SentimentMEMES, like all meme coins, is ultimately tied to the health of the broader cryptocurrency market. Strong bullish trends in Bitcoin (BTC) generally create a “rising tide lifts all boats” effect, increasing risk appetite and capital flow into speculative assets like MEMES. Conversely, a crypto bear market would likely lead to decreased interest and downward price pressure.

Realistic 2026 Price Forecast Tabletd {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

TimelineLow EstimateMid-RangeHigh EstimateNotesQ1 2026$0.00$0.00$0.00Attention testing phaseQ2 2026$0.00$0.00$0.00Possible meme season alignmentQ3–Q4 2026$0.00$0.00$0.00If cycles repeat & liquidity holdsWhere to Trade MEMES Coin?MEMES is primarily traded on BNB Chain DEXs (PancakeSwap, etc.). For those looking to trade with leverage or in a regulated environment, WEEX now offers MEMES/USDT spot.

Why trade MEMES on WEEX?Competitive trading feesReal-time price charts and trading tools24/7 customer supportHigh liquidity and fast order executionGetting started to Buy Memes Will Continue (MEMES)Memes Will Continue (MEMES) is now officially available for spot trading on WEEX. The token was listed on January 21, 2026, at 05:30 (UTC+0), providing users with a secure and user-friendly centralized exchange option to trade Memes Will Continue (MEMES).

Below is a clear, step-by-step guide to purchasing MEMES on WEEX.

Step 1: Create Your WEEX AccountGo to WEEX official site and click on the "Sign Up" button.

Step 2: Deposit FundsOnce logged in, deposit funds into your WEEX account. You can choose from multiple deposit methods:

Fiat: Deposit via bank transfer, credit/debit card, or supported payment providers.Crypto deposit: Transfer USDT, BNB, or other supported cryptocurrencies into your WEEX wallet. Ensure the network selected matches WEEX’s supported networks (such as BNB Smart Chain for BNB deposits).Step 3: Locate the MEMES Trading PairAfter your funds are credited, go to the “Spot Trading” section. In the search bar, type “MEMES” and select the relevant trading pair. WEEX currently offers MEMES/USDT for spot trading.

Step 4: Place Your Buy OrderOn the trading interface, you can choose between:

Market Order: Buy MEMES instantly at the current market price.Limit Order: Set your preferred price and wait for the order to be filled.Enter the amount of MEMES you wish to purchase, review the details, and confirm the transaction.

Step 5: Secure Your CoinsOnce purchased, Memes Will Continue (MEMES) will appear in your WEEX spot account. For long-term holding, consider transferring your tokens to a secure external wallet that supports BEP-20 (BNB Smart Chain) tokens.

Security Reminders:

Always trade through the official WEEX platform.Enable two-factor authentication (2FA) on your WEEX account.Verify trading pairs and contract details before execution.Withdraw to a trusted self-custody wallet for enhanced security.Final Thoughts: Can MEMES Coin Survive the Hype Cycle?The most realistic MEMES coin price prediction for 2026 isn’t about exponential gains—it’s about whether MEMES can survive the hype cycle and retain attention.

The token shows early signs of structural discipline: controlled volatility, active volume participation, and a lack of panic selling. In a market where thousands of meme coins vanish monthly, survival itself becomes a bullish indicator.

For traders, MEMES represents a case study in meme coin maturation—a token transitioning from noise to potential structure. Watch for volume resurgences, social reactivation, and BNB Chain meme rotations as key signals for 2026 price action.

Ready to trade Memes Will Continue (MEMES) and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingIntroduction to Fogo (FOGO) Coin: Is Fogo (FOGO) Coin a Good Investment?Which Crypto Will Go 1000x in 2026?Is JGGL (JGGL) a Good Investment? JGGL (JGGL) Price PredictionDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Buy USDC with UPI on WEEX P2P – 0 Fee & 24/7 INR Ads

UPI is recognized across India as a leading solution for fast and seamless cryptocurrency purchases using INR. With WEEX P2P, users can buy crypto directly through UPI with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better INR exchange rates, safer escrow protection, and more available ads for UPI users.

With more users in India turning to crypto, having easy and safe access to digital assets has become increasingly important. With WEEX P2P, users can buy USDT, BTC, or ETH via UPI with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for UPI Users

WEEX P2P offers key advantages to users purchasing crypto with INR via UPI:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest INR exchange rates for UPI users: Enjoy highly competitive pricing tailored for UPI paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore UPI ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 INR or 1,000,000 INR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy USDC with UPI on WEEX P2P

Buying crypto with UPI on WEEX is simple and fast. Follow these steps: